Understanding Fire Insurance

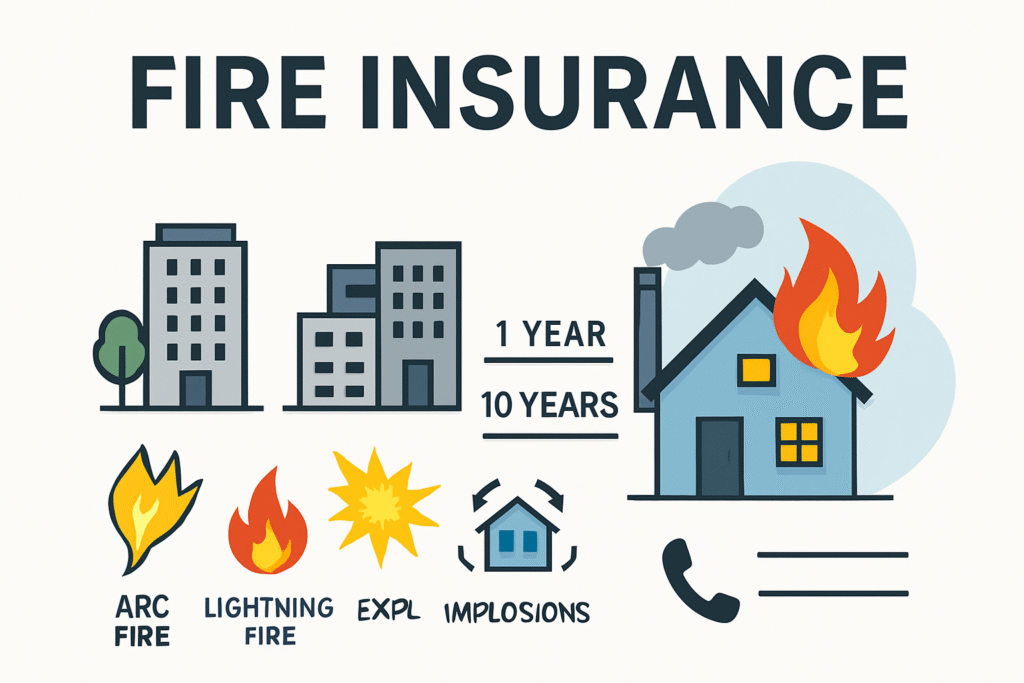

Fire accidents can cause sudden and massive destruction to homes, shops, warehouses, and factories across India. In a country where fire hazards are frequent due to electrical issues, industrial risks, or natural causes, having the right coverage becomes crucial. To ensure safety, individuals and businesses must be aware of the advantages of fire insurance. Through its platform, KaroInsure helps Indian clients access IRDAI-approved fire insurance policies, ensuring protection for residential, commercial, industrial, and agricultural assets.

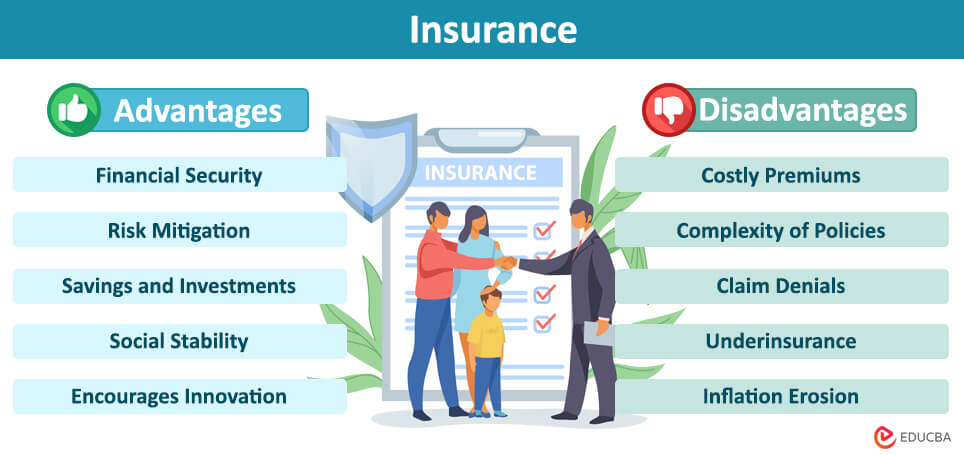

Fire insurance is a type of property insurance that provides financial compensation for damages or losses caused by fire and related perils. It is based on principles such as indemnity, insurable interest, and utmost good faith. The advantages of fire insurance extend beyond just financial protection, offering peace of mind and long-term stability. KaroInsure connects clients with policies that are transparent, reliable, and tailored to their needs.

Financial Protection Against Fire Losses

One of the primary advantages of fire insurance is financial protection. Fire insurance ensures that the insured is compensated for the actual losses caused by fire, helping individuals and businesses recover quickly.

- Homeowners can secure compensation for damaged property and belongings.

- Business owners can protect commercial establishments, warehouses, and stock-in-trade.

- Industrial units can safeguard expensive machinery and raw materials.

KaroInsure assists Indian clients in choosing policies that provide the right financial safety net.

Business Continuity and Stability

For businesses in India, one of the most crucial advantages of fire insurance is ensuring continuity of operations. Fires can lead to major disruptions, but insurance minimizes downtime by covering asset losses and, in some cases, business interruption.

- Small shops and startups benefit from quick recovery support.

- Large factories can restart production without heavy financial burden.

- Service providers can safeguard office infrastructure.

KaroInsure helps entrepreneurs and enterprises identify policies that include add-ons like business interruption cover for better security.

Peace of Mind for Families and Owners

Peace of mind is among the intangible but significant advantages of fire insurance. Knowing that property and valuables are protected helps Indian families and business owners focus on their lives and operations without constant worry about fire hazards.

KaroInsure ensures this peace of mind by providing easy comparisons and guiding clients through the policy selection process.

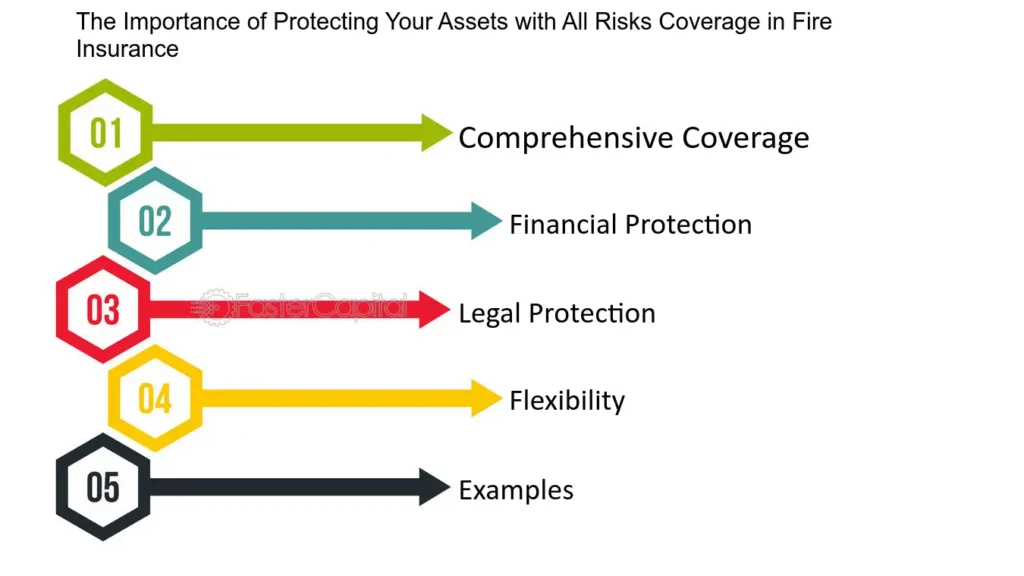

Wide Coverage Options

Another key benefit is the wide range of coverage. The advantages of fire insurance include flexibility to insure different types of properties and assets:

- Residential Coverage: Houses, flats, furniture, and personal belongings

- Commercial Coverage: Shops, offices, and stock-in-trade

- Industrial Coverage: Factories, machinery, raw materials, and equipment

- Agricultural Coverage: Farmhouses, barns, and produce storage

Through KaroInsure, Indian clients can customize coverage with add-ons like loss of rent, debris removal, and alternate accommodation.

Compliance with Lenders and Regulations

Many financial institutions in India require borrowers to have fire insurance when taking loans against property, factories, or warehouses. Thus, one of the indirect advantages of fire insurance is fulfilling compliance with lenders and regulatory authorities.

KaroInsure simplifies this process by helping clients select the right policy to meet these requirements.

Claim Benefits and Quick Recovery

The ability to file claims and recover losses is one of the most practical advantages of fire insurance. The process ensures:

- Immediate reporting of fire incidents

- Surveyor assessment of damages

- Submission of documents like fire brigade and police reports

- Settlement of claims based on actual loss

KaroInsure supports clients during the claim process, making recovery smoother and faster.

Cost-Effective Protection

Another important factor is affordability. The advantages of fire insurance include providing comprehensive protection at relatively low premiums compared to the value of assets insured.

- Homeowners can insure property for a nominal yearly premium.

- Businesses can cover large inventories at affordable rates.

- Industries can secure expensive machinery with flexible options.

KaroInsure helps clients compare multiple insurers to find the most cost-effective plans.

Contribution to Risk Management

Fire insurance also contributes to overall risk management for businesses and individuals. Among the advantages of fire insurance, it encourages responsible behavior by making policyholders adopt safety measures like fire extinguishers, alarms, and preventive maintenance.

This not only reduces the likelihood of incidents but also strengthens claim settlement chances.

Exclusions to Remember

While the advantages of fire insurance are extensive, clients should also know about exclusions. Most policies do not cover:

- Damage due to war or nuclear risks

- Fires caused intentionally or by gross negligence

- Gradual wear and tear of property

- Loss of cash, jewelry, or valuables unless specified

KaroInsure guides clients carefully through these exclusions to avoid confusion later.

Why Choose KaroInsure

The advantages of fire insurance become more meaningful when clients choose the right platform. KaroInsure offers:

- Access to multiple IRDAI-approved insurers

- Transparent comparison of policies

- Expert guidance for choosing coverage and add-ons

- Support during claims for smoother recovery

With KaroInsure, Indian clients gain not only financial protection but also trusted service and peace of mind.

Conclusion

In conclusion, the advantages of fire insurance include financial protection, business continuity, peace of mind, wide coverage, affordability, and compliance benefits. For Indian individuals, families, and businesses, fire insurance is not just an option but a necessity in today’s uncertain environment. Through its reliable platform, KaroInsure helps clients explore the advantages of fire insurance, compare policies, and secure the best coverage for their needs. By doing so, KaroInsure ensures that valuable assets are protected, risks are minimized, and recovery is made easier after unexpected fire incidents.

Leave a Reply