Corporate decisions shape the growth, direction, and reputation of a business. However, in today’s complex business environment, directors and senior officers can face personal liability for the decisions they make on behalf of their organizations. This is where Directors and Officers Insurance becomes essential.

For Indian companies—whether startups, SMEs, or large enterprises—protecting leadership from unforeseen claims is not only smart but critical for long-term stability. With KaroInsure, businesses can access IRDAI-approved insurers that offer comprehensive Directors and Officers Insurance tailored to their unique risks.

What is Directors and Officers Insurance?

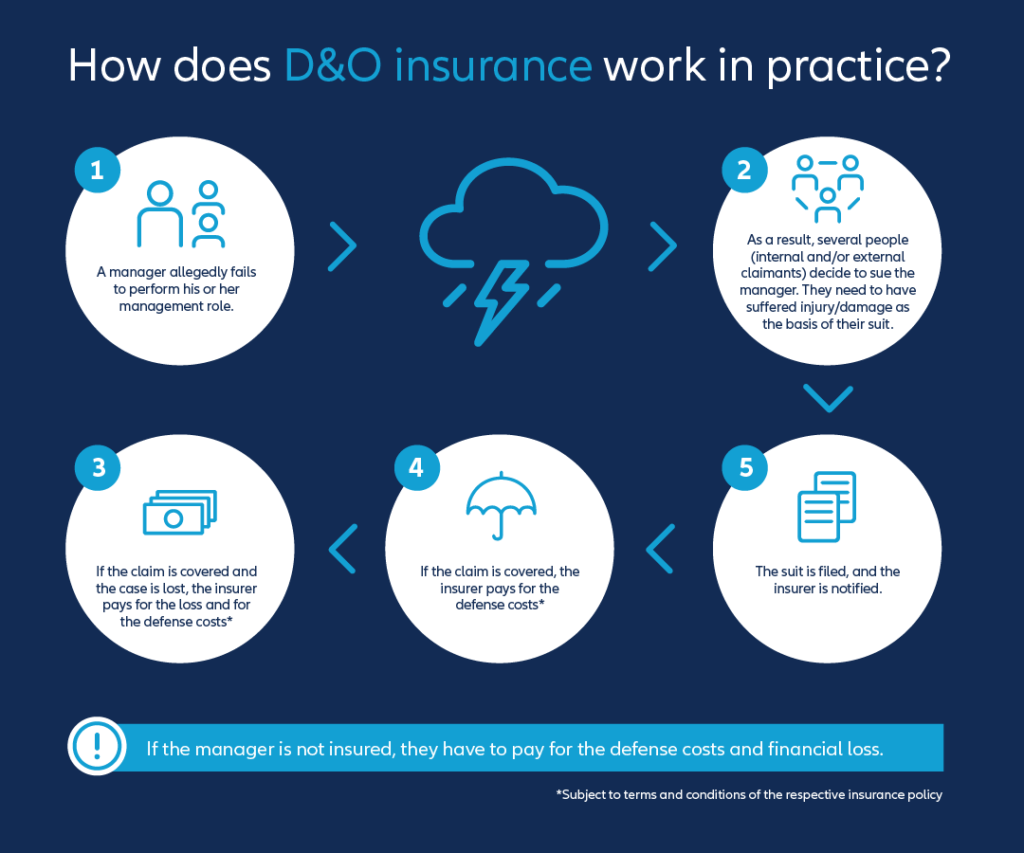

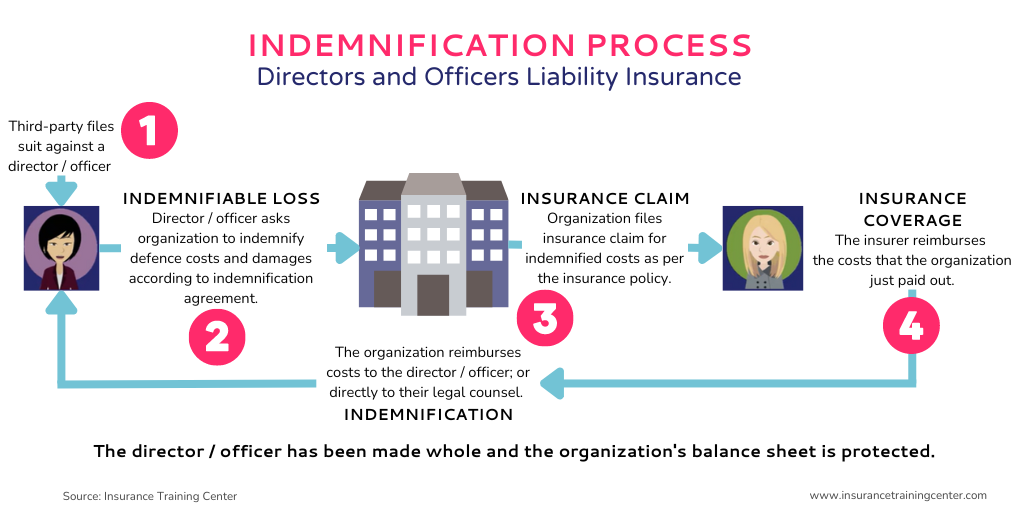

Directors and Officers Insurance is a specialized policy that protects the personal assets of company directors and key officers in case they are sued for decisions or actions taken while managing the company.

It covers defense costs, settlements, and damages arising from allegations of:

- Mismanagement

- Breach of fiduciary duty

- Errors and omissions

- Misrepresentation of company assets

- Negligence

This ensures that business leaders can focus on decision-making without the fear of personal financial ruin.

Why is Directors and Officers Insurance Important in India?

The Indian corporate sector is rapidly evolving, and with it comes increased scrutiny from regulators, shareholders, employees, and the public. Common scenarios where Directors and Officers Insurance becomes vital include:

- Shareholder lawsuits over financial mismanagement

- Employee claims of wrongful termination or discrimination

- Regulatory investigations and penalties

- Creditor claims in case of company insolvency

- Claims of negligence in mergers, acquisitions, or partnerships

Without insurance, directors and officers may have to pay out-of-pocket, risking personal assets like homes, savings, and investments.

Coverage Offered

A comprehensive Directors and Officers Insurance policy in India generally includes:

- Legal Defense Costs – Covers expenses of hiring legal experts.

- Settlements and Damages – Payment for claims arising from lawsuits or disputes.

- Regulatory Investigations – Protection from penalties and legal costs due to government or regulatory body inquiries.

- Employment Practices Liability – Coverage against employee-related claims like harassment or wrongful dismissal.

- Reputation Management – In some cases, costs of PR efforts to handle negative publicity are included.

What Directors and Officers Insurance Does Not Cover

While coverage is extensive, certain exclusions apply, such as:

- Fraudulent or criminal acts

- Deliberate dishonesty

- Bodily injury or property damage (covered under other policies)

- Pending or prior litigation before policy purchase

- Personal profit gained illegally

Who Needs Directors and Officers Insurance in India?

It is essential for:

- Publicly Listed Companies – Where shareholder lawsuits are common.

- Private Limited Companies – To protect founders and directors from partner or investor disputes.

- Startups – Attracting investors becomes easier when leadership is protected.

- Non-Profit Organizations – Directors face similar risks as corporate leaders.

- SMEs and Family Businesses – Protection against employee, vendor, or client claims.

KaroInsure connects businesses of all sizes with the right insurers offering customized D&O policies.

Benefits of Directors and Officers Insurance for Indian Companies

- Protects Personal Assets – Shields directors’ personal wealth from legal claims.

- Ensures Business Stability – Avoids financial disruptions due to lawsuits.

- Boosts Investor Confidence – Investors feel safer knowing leadership is covered.

- Attracts Top Talent – Senior professionals prefer working with companies offering D&O protection.

- Compliance and Governance – Strengthens corporate governance and reduces risks.

Why Choose KaroInsure for Directors and Officers Insurance?

KaroInsure is a trusted Indian insurance broker that makes Insurance accessible and transparent.

- Partnerships with leading IRDAI-approved insurers

- Tailored coverage for startups, SMEs, and corporates

- Competitive premium options

- Expert guidance in policy selection

- End-to-end support from purchase to claim settlement

With KaroInsure, Indian companies can safeguard their leadership and ensure that decision-making happens without fear of personal liability.

Conclusion

In today’s business world, corporate leaders face increasing legal and financial risks. Directors and Officers Insurance acts as a safety net, protecting decision-makers from personal liability while supporting business continuity.

For Indian businesses, whether new or established, choosing the right D&O insurance through KaroInsure ensures leadership protection, investor confidence, and smooth governance.

Leave a Reply