In today’s competitive and highly regulated corporate environment, business leaders are constantly exposed to risks. A single decision, whether related to finance, compliance, or management, can result in lawsuits or regulatory actions. For directors and senior officers of Indian companies, this exposure can lead to personal financial losses. To mitigate such risks, businesses need Directors and Officers Liability Insurance.

KaroInsure, as a trusted insurance broker, helps Indian companies access IRDAI-approved insurers offering customized solutions that protect leadership and strengthen corporate governance.

What is Directors and Officers Liability Insurance?

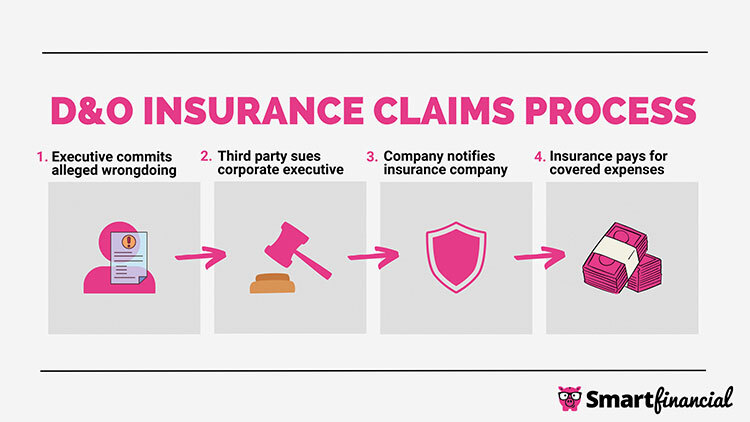

D&O Liability Insurance, is a specialized policy that protects the personal assets of company directors and senior officers if they are sued for decisions made in their professional roles.

This policy covers defense costs, settlements, and damages arising from claims of:

- Mismanagement of company funds

- Breach of fiduciary duty

- Negligence in decision-making

- Misrepresentation of financial status

- Non-compliance with laws or regulations

In short, it ensures that leaders can focus on business growth without the constant fear of personal liability.

Why is Directors and Officers Liability Insurance Important in India?

The importance of this Insurance has grown in India due to:

- Stricter Regulations – SEBI, RBI, and MCA have introduced stringent governance norms.

- Shareholder Activism – Investors are more vigilant and may file lawsuits for mismanagement.

- Employee Lawsuits – Wrongful termination, discrimination, or harassment claims can target directors personally.

- Vendor and Creditor Disputes – Especially in insolvency or contract breaches.

- Reputation Risks – Legal claims can harm not just finances but also leadership credibility.

Without insurance, directors and officers may have to pay legal and settlement costs from their own assets, which can be financially devastating.

Coverage Offered by and Exclusions of Directors and Officers Liability Insurance

A standard policy in India covers:

- Legal Defense Costs – Fees for lawyers and court proceedings.

- Settlements and Damages – Payments for claims and judgments.

- Regulatory Investigations – Legal expenses due to inquiries by government or regulatory authorities.

- Employment Practices Liability – Claims arising from wrongful termination, harassment, or discrimination.

- Reputational Crisis Management – In some cases, costs related to public relations and crisis management.

Exclusions

While coverage is wide, certain exclusions apply:

- Fraudulent or criminal acts

- Intentional non-compliance

- Bodily injury and property damage (covered under other policies)

- Prior known claims before the policy purchase

- Illegal personal profits or advantages

Who Needs Directors and Officers Liability Insurance in India?

- Publicly Listed Companies – To protect against shareholder lawsuits and regulatory risks.

- Private Limited Companies – Founder-directors face investor disputes and legal claims.

- Startups – Investors often demand D&O cover before funding.

- SMEs and Family Businesses – Even small companies face employee or vendor lawsuits.

- Non-Profit Organizations – Trustees and directors are equally at risk of legal actions.

Benefits of Directors and Officers Liability Insurance

- Personal Asset Protection – Shields directors from paying liabilities out of personal wealth.

- Legal Support – Provides financial assistance for defense and settlements.

- Investor Confidence – Shows strong governance practices, attracting funding.

- Talent Retention – Helps companies attract and retain experienced directors and executives.

- Business Continuity – Ensures lawsuits don’t disrupt operations.

Why Choose KaroInsure for Directors and Officers Liability Insurance?

KaroInsure is a trusted Indian insurance broker that connects companies with leading IRDAI-approved insurers to provide customized policies.

- Wide choice of insurers

- Tailored policies based on company size and risk exposure

- Transparent pricing and competitive premiums

- Expert consultation and guidance

- Hassle-free claim assistance

By partnering with KaroInsure, Indian businesses ensure their leaders remain protected while focusing on innovation and growth.

Conclusion

In today’s environment of rising regulations, lawsuits, and investor vigilance, protecting leadership is not optional—it’s essential. Directors and Officers Liability Insurance safeguards the personal assets of directors and senior executives while strengthening overall business confidence.

With KaroInsure, Indian companies can easily access comprehensive D&O liability coverage, ensuring that their leadership can take bold decisions without the fear of personal risk.

Leave a Reply