Running a business in India involves multiple risks. From customer interactions to supplier contracts and daily operations, unexpected events can lead to claims of bodily injury, property damage, or reputational harm. These claims can not only disrupt business operations but also result in heavy financial liabilities. To protect against such risks, companies rely on Commercial General Liability Insurance.

KaroInsure, a trusted insurance broker, helps Indian businesses access IRDAI-approved insurers offering tailored Commercial General Liability Insurance policies that safeguard enterprises against third-party claims.

What is Commercial General Liability Insurance?

Commercial General Liability Insurance (CGL Insurance) is a policy designed to protect businesses against financial losses arising from third-party claims of:

- Bodily injury

- Property damage

- Personal injury (such as defamation or copyright infringement)

This type of insurance ensures that a single incident doesn’t drain a company’s resources or reputation.

Importance in India

In a growing economy like India’s, businesses face increasing exposure to third-party risks. A customer slipping on wet office flooring, a supplier claiming damages due to mishandling of goods, or even allegations of advertising infringement can result in expensive lawsuits.

With this Insurance Policy, Indian businesses get:

- Financial protection from compensation claims

- Coverage for legal defense costs

- Enhanced trust among clients, vendors, and investors

- Compliance benefits, especially in contracts requiring liability coverage

Coverage Provided by Commercial General Liability Insurance

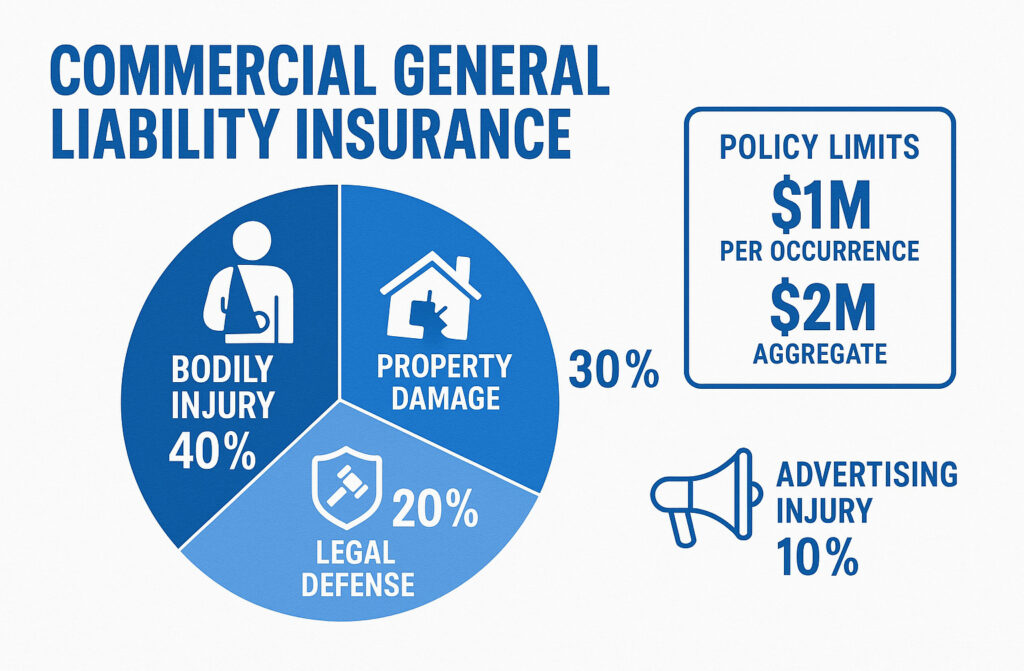

A comprehensive Insurance policy typically includes:

- Bodily Injury – Compensation for physical injuries caused to third parties.

- Property Damage – Covers accidental damage to third-party property.

- Medical Payments – Immediate medical expenses for injuries occurring on business premises.

- Personal and Advertising Injury – Protection against libel, slander, copyright, or false advertising claims.

- Legal Defense Costs – Payment of lawyer fees and court charges.

What is Not Covered in Commercial General Liability Insurance?

Though broad in coverage, some exclusions apply:

- Intentional damage caused by the business

- Employee injuries (covered under Workmen’s Compensation Insurance)

- Professional negligence (covered under Professional Indemnity Insurance)

- Contractual liabilities unless specified

- Fines and penalties due to illegal activities

Industries That Need Commercial General Liability Insurance in India

This Insurance is essential for a wide range of industries, including:

- Manufacturing Units – Protection against product-related damages.

- Retail Stores and Malls – High customer footfall increases accident risks.

- Hospitality Sector – Hotels, restaurants, and resorts face frequent third-party claims.

- IT and Advertising Firms – Coverage against advertising-related disputes.

- Healthcare Providers – Hospitals and clinics need CGL in addition to medical malpractice coverage.

- SMEs and Startups – Small businesses benefit from affordable liability protection.

KaroInsure connects these businesses with suitable insurers offering customized liability solutions.

Benefits of Commercial General Liability Insurance

- Financial Security – Shields businesses from sudden claim-related expenses.

- Legal Protection – Covers defense costs in lengthy lawsuits.

- Reputation Safeguard – Helps maintain brand credibility during disputes.

- Client Confidence – Many clients prefer working with businesses carrying liability cover.

- Business Continuity – Ensures smooth operations despite unexpected claims.

Why Choose KaroInsure for Commercial General Liability Insurance?

KaroInsure simplifies the process of buying Commercial General Liability Insurance by offering:

- Partnerships with multiple IRDAI-approved insurers

- Industry-specific policy customization

- Transparent premium options

- End-to-end claim support

- Expert guidance to choose the right liability coverage

By partnering with KaroInsure, Indian businesses can operate confidently, knowing they are protected from unforeseen third-party risks.

Conclusion

In the dynamic Indian business environment, where risks are increasing and consumer awareness is rising, having Commercial General Liability Insurance is no longer optional. It is a necessity for safeguarding assets, maintaining trust, and ensuring financial stability.

With KaroInsure, companies of all sizes—from startups to large enterprises—can secure the right liability coverage and continue growing without fear of unexpected claims.

Leave a Reply