What Is a Term Life Policy and How Does It Work?

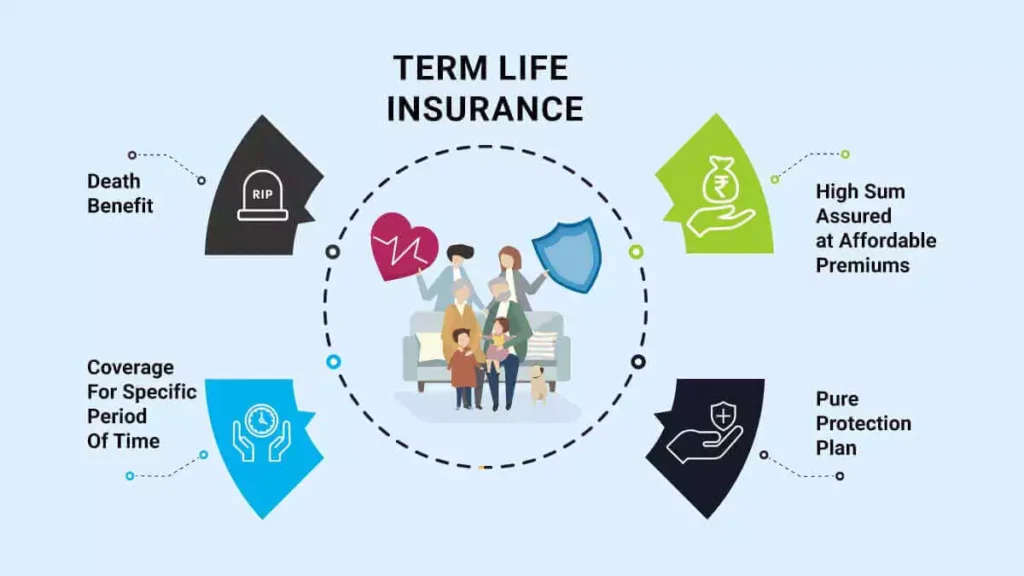

A term life insurance policy is one of the simplest and most affordable ways to secure your family’s financial future. You pay a fixed premium for a specific number of years, and if something unfortunate happens during that term, your family receives a lump-sum payout.

This ensures that your loved ones remain financially stable, even when you’re not around to support them.

Why Every Family Needs Life Protection

Life is uncertain. Having the right protection means peace of mind — knowing your family will be safe from financial hardship. Term insurance offers large coverage at a relatively low premium, which makes it ideal for working professionals, parents, and anyone with dependents.What Is a Term Life Policy and How Does It Work?

How a Term Plan Keeps Your Family Secure

In a term plan, you select the coverage amount and tenure that fits your income and goals.

If the insured person passes away during this period, the nominee receives the full amount — helping them manage daily expenses, loans, and future needs such as education or marriage.

The simplicity and clarity of these plans make them one of the best options for long-term financial safety.

Different Types of Term Insurance Policies

There are several types of life insurance plans you can choose from:

- Level Term Plan – Premium and coverage remain constant throughout the policy.

- Increasing Term Plan – Coverage increases each year to beat inflation.

- Decreasing Term Plan – Best suited for people with loans that reduce over time.

- Return of Premium Plan – Refunds your premiums if you survive the term.

Each type serves a unique purpose — pick one that aligns with your lifestyle and financial priorities.

Key Benefits of Choosing a Term Plan

- Affordable premiums – Get high coverage at a low cost.

- Tax benefits – Premiums qualify for deductions under Section 80C and 10(10D) of the Income Tax Act.

- Financial security – Your family stays protected against debts and daily expenses.

- Flexible add-ons – Add riders like accidental death or critical illness for extra safety.

Mistakes to Avoid When Buying Life Coverage

Even the best plans can fall short if you make common mistakes such as:

- Choosing coverage that’s too low for your family’s actual needs.

- Not disclosing health or lifestyle details honestly.

- Ignoring the claim settlement ratio of your insurer.

- Delaying purchase — premiums rise with age.

Avoid these errors to ensure your policy truly safeguards your loved ones.

How KaroInsure Helps You Find the Best Policy

At KaroInsure, we simplify insurance for you. Our platform compares leading term plans in India, explains benefits clearly, and helps you make an informed choice — without hidden jargon or confusing terms.

We focus on honest advice, transparent pricing, and long-term trust.

Read more about health insurance benefits here

Check IRDAI’s official website for updated insurance guidelines

Conclusion

A term plan isn’t just a policy — it’s a promise of protection and stability. By choosing the right coverage today, you ensure that your family’s tomorrow is financially secure, no matter what happens.

Leave a Reply