Health is the foundation of every happy family, but medical expenses in India are rising faster than ever. From hospital bills to regular checkups, one illness can strain your finances. That’s why family health insurance plans have become essential — they provide comprehensive protection for every family member under one policy.

At KaroInsure, we help Indian families compare and choose the right health insurance plans from trusted insurers, ensuring both affordability and peace of mind. Let’s explore the key benefits of family health plans and why every household should have one.

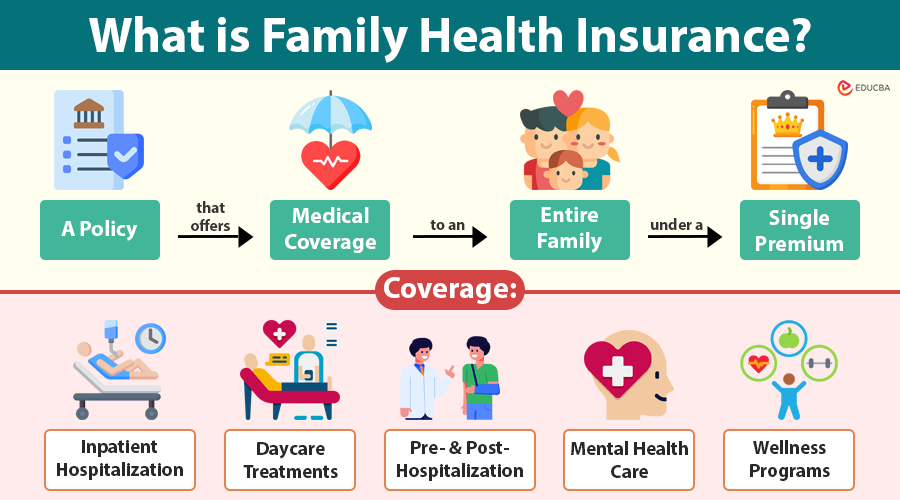

What Is a Family Health Plan?

A family health insurance plan, often known as a family floater policy, covers all family members — husband, wife, children, and sometimes even parents — under a single sum insured. Instead of managing multiple policies, you enjoy one simple, cost-effective plan that protects your entire family.

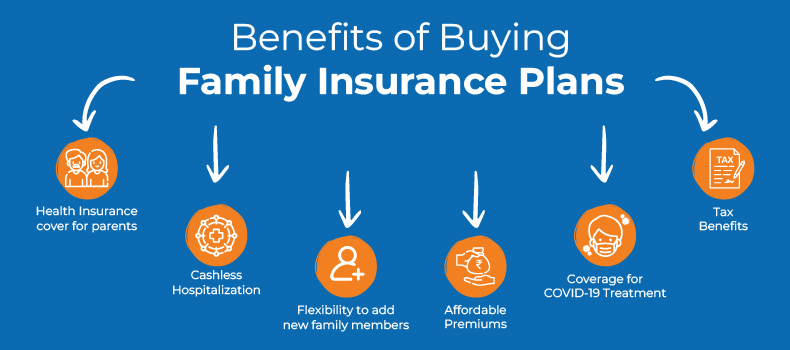

Cost-Effective Coverage for All

One of the biggest benefits of family health plans is cost efficiency. Compared to buying separate policies for each family member, a single family floater plan offers combined coverage at a much lower premium. This is ideal for young couples or families with children, as the risk is shared among all insured members.

For example, instead of paying for four individual ₹5 lakh plans, a single ₹10 lakh family plan can cover everyone — saving you money while maintaining strong protection.

Simplified Management and Renewals

Managing multiple health insurance policies can be confusing — different premium dates, renewal cycles, and claim procedures. With a family floater plan, you only need to track one premium and one renewal date, making it far easier to maintain continuous coverage.

At KaroInsure, we assist clients in setting up reminders and renewals so they never miss a deadline.

Shared Sum Insured for Better Flexibility

A family health plan allows all members to use the total sum insured based on need. For instance, if one member is hospitalized, the entire coverage can be used for that treatment. This flexibility ensures maximum utilization of your premium and eliminates unused benefits across multiple policies.

Comprehensive Protection for Every Age Group

Family health plans in India now include coverage for:

- Hospitalization expenses

- Pre and post-hospitalization costs

- Daycare procedures

- Maternity and newborn care

- Ambulance and room rent charges

KaroInsure helps you find plans that offer the best protection for all age groups, including senior citizens and children.

Tax Benefits Under Section 80D

Another major benefit of family health plans is the tax saving. Premiums paid for family health insurance are eligible for deductions under Section 80D of the Income Tax Act. You can save up to ₹75,000 annually depending on the age of family members insured.

Cashless Hospitalization Network

Most family health insurance plans offer cashless treatment at network hospitals. This means you don’t need to pay bills upfront — the insurer settles them directly with the hospital. Through KaroInsure, you can access an extensive list of partner hospitals across India, ensuring convenience during emergencies.

Customizable Add-Ons for Complete Coverage

Modern family plans allow you to include add-ons like critical illness cover, maternity benefits, or daily hospital cash allowance. These additions ensure that your policy perfectly matches your family’s health needs.

KaroInsure helps families choose the right add-ons without overpaying for unnecessary extras.

Peace of Mind for the Whole Family

When health emergencies strike, the last thing you should worry about is money. A well-chosen family health plan ensures your loved ones get the best medical care without financial stress. It provides peace of mind, knowing that your family’s well-being is secured no matter what.

Conclusion

Investing in a family health plan is more than just buying insurance — it’s an act of care and responsibility. In 2025, as healthcare costs continue to rise, protecting your family under one comprehensive policy is the smart choice.

At KaroInsure, we make it easy to compare top family health plans, understand features, and find the best one that fits your budget and lifestyle. Secure your family’s health today with trusted guidance from KaroInsure.

Leave a Reply