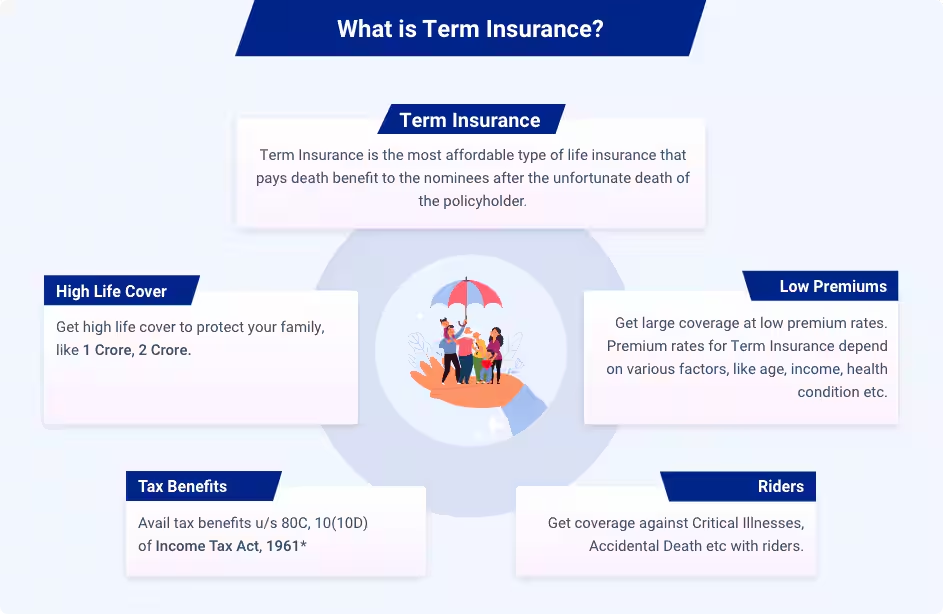

Understanding Term Insurance

Life is unpredictable. Term insurance gives your loved ones financial security if something unexpected happens to you. It’s a simple and affordable plan that pays a lump sum to your family in case of your untimely death during the policy term.

Unlike investment-linked plans, term insurance focuses purely on protection — ensuring your family stays financially stable even in your absence.

The Real Value of Term Insurance

Term insurance matters because it offers peace of mind and financial stability at a low cost. With just a small premium, you can safeguard your family’s future goals — from your child’s education to loan repayments and household needs.

In a country like India, where most families depend on a single breadwinner, this protection becomes essential.

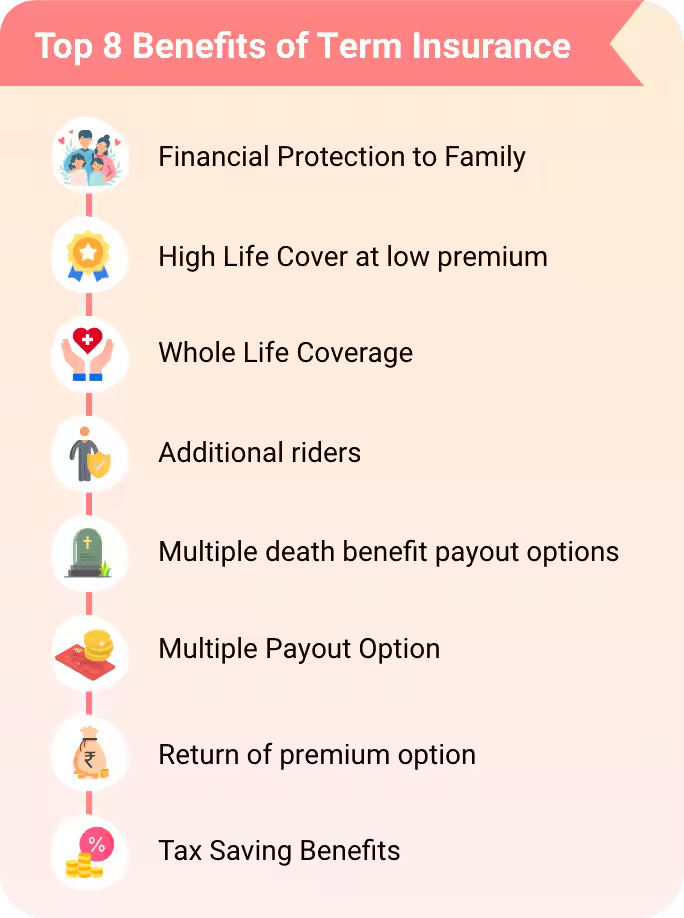

Key Benefits of Term Insurance

- Affordable Coverage: Get large financial protection at minimal cost.

- Income Replacement: Helps your family maintain their lifestyle and cover expenses.

- Debt Protection: Prevents loans or EMIs from burdening your loved ones.

- Tax Benefits: Premiums qualify for deductions under Section 80C and payouts are exempt under Section 10(10D).

- Add-On Options: Riders for critical illness or accidental death can expand coverage.

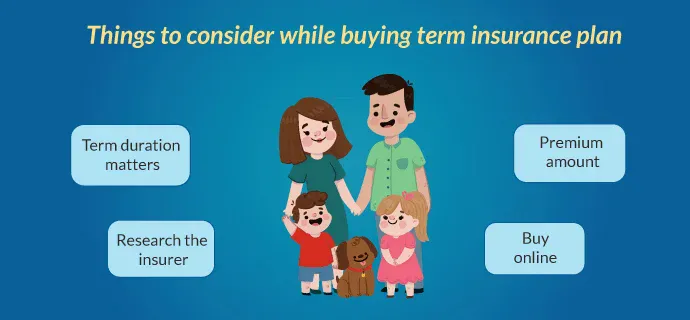

Choosing the Right Term Plan

When selecting a term plan, focus on these factors:

- Coverage Amount: Ideally, 10–15 times your annual income.

- Claim Settlement Ratio: Choose insurers with a strong record of paying claims promptly.

- Policy Duration: Pick a term that covers your major financial responsibilities.

- Add-Ons: Consider riders for better protection.

KaroInsure helps you compare policies from top insurers and choose the one that best fits your life stage and budget.

Why Buy Early?

The earlier you buy term insurance, the lower your premium. Younger policyholders enjoy better health conditions and longer coverage at reduced cost. Delaying the purchase only increases premiums and may limit your eligibility.

KaroInsure Makes It Simple

Buying insurance shouldn’t be confusing. KaroInsure simplifies the process with expert comparisons, transparent quotes, and end-to-end claim support. Our goal is to help you secure the right term plan without stress or hidden terms.

Conclusion

Term insurance isn’t just a policy — it’s a promise of protection for your loved ones. It ensures that your family’s future is safe, no matter what life brings. That’s why term insurance truly matters.

With KaroInsure, you can compare, understand, and buy the best plans — all in one trusted place.

Leave a Reply