Why Buying Life Insurance Early Matters

Life insurance is one of the smartest financial decisions you can make — and the earlier you buy it, the better. Many people delay getting insurance, thinking they’re too young or healthy to need it. But the truth is, buying life insurance early helps you save more, get better coverage, and secure peace of mind for the years ahead.

At KaroInsure, we believe that financial protection should begin as soon as your earning journey starts. Let’s explore why early planning makes a big difference.

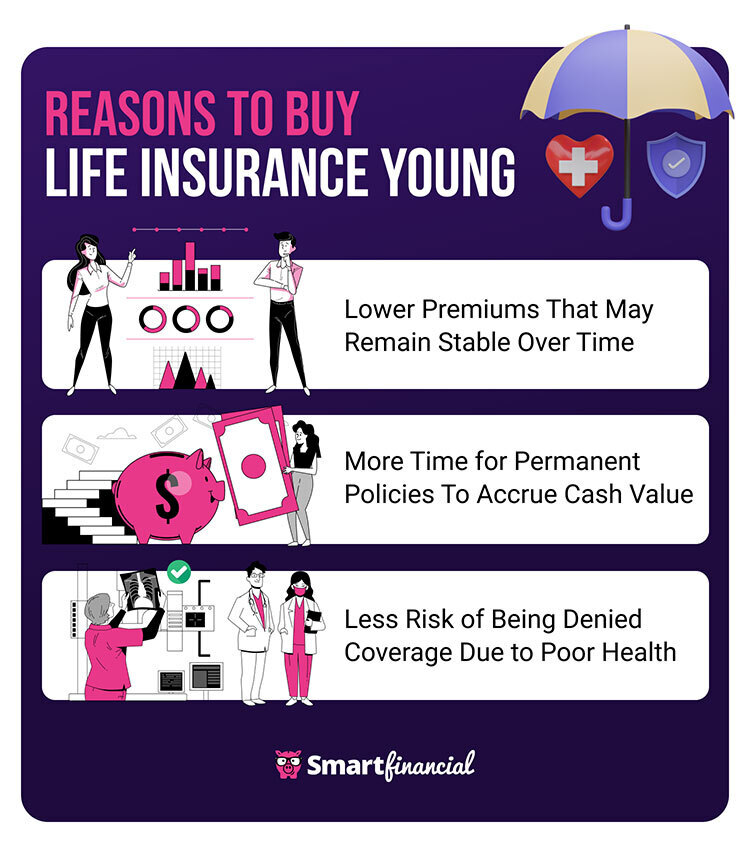

1. Lower Premiums for the Same Coverage

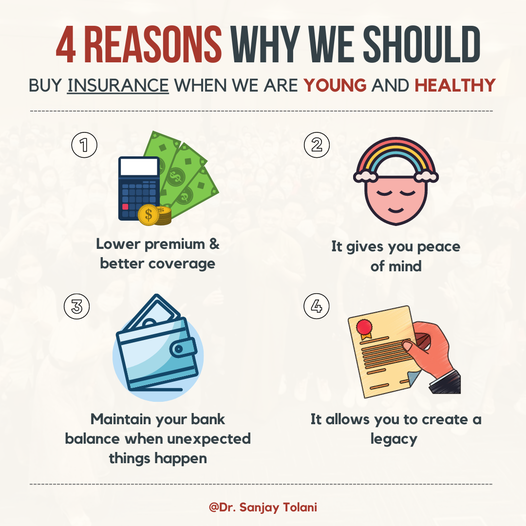

Age plays a major role in determining life insurance premiums. The younger you are, the lower your premiums will be. When you buy early, insurers view you as a lower risk, offering high coverage at affordable rates.

For example, a 25-year-old might pay almost half of what a 35-year-old would for the same ₹1 crore coverage — a clear win for early planners.

2. Long-Term Financial Security

Starting early ensures your family’s financial stability, no matter what happens. Whether it’s your parents, spouse, or future children, your life insurance policy acts as a safety net against income loss, debts, or other financial shocks.

With KaroInsure, you can easily find plans that match your income and life stage — keeping your family protected for decades.

3. Better Coverage Options

Younger applicants usually enjoy better health, which makes it easier to qualify for higher coverage and additional riders like critical illness or accidental death benefits. Buying early ensures you get comprehensive protection without medical complications affecting eligibility.

4. Builds Financial Discipline

When you start paying premiums early, you cultivate financial responsibility. It encourages long-term planning and helps align your insurance with other goals such as investments, education, or retirement savings.

5. Peace of Mind for the Future

Life is unpredictable, and uncertainties can strike anytime. Having life insurance from a young age means you don’t have to worry about “what-ifs.” Your loved ones stay financially secure even in your absence — that’s true peace of mind.

6. Easier Claim Process and Long-Term Trust

Long-standing policyholders often enjoy smoother claim experiences, as insurers have long-term customer records and trust built over time. KaroInsure works only with IRDAI-approved insurers in India, ensuring transparent claims and reliable support whenever needed.

Conclusion

Buying life insurance early isn’t just about saving money — it’s about protecting your dreams and your family’s future. The sooner you start, the more advantages you gain.

With KaroInsure, you can compare top insurers, choose the right plan, and secure your financial future in just a few clicks. Don’t wait — your best time to buy life insurance is now.

Leave a Reply