Choosing the right insurance plan is one of the most important financial decisions you’ll make. With so many insurers and options available, it can be confusing to know which policy truly fits your needs. This is where learning how to compare insurance policies the right way becomes essential.

At KaroInsure, we simplify the process—helping you find the best coverage at the most affordable rates. Let’s understand how to make the smartest comparison before you buy.

1. Identify Your Needs First

Before comparing plans, determine what you actually need.

Are you looking for health insurance, life coverage, or vehicle protection?

Understanding your goals—whether it’s family security, medical care, or financial protection—will help you shortlist only the most relevant options.

2. Check the Coverage Details

Every policy is unique. When you compare insurance policies, pay close attention to:

- Sum assured or coverage limit

- Inclusions and exclusions

- Waiting periods (for health plans)

- Policy duration and renewal options

Don’t just go by the price—make sure the coverage aligns with your lifestyle and financial goals.

3. Compare Premiums and Benefits

Price matters, but value matters more. Two plans may offer similar coverage but differ in premium rates and added benefits.

Use trusted comparison tools like KaroInsure to see side-by-side differences in:

- Premium costs

- Rider options (like accidental or critical illness cover)

- Claim settlement ratios

This helps you make a fair and informed choice.

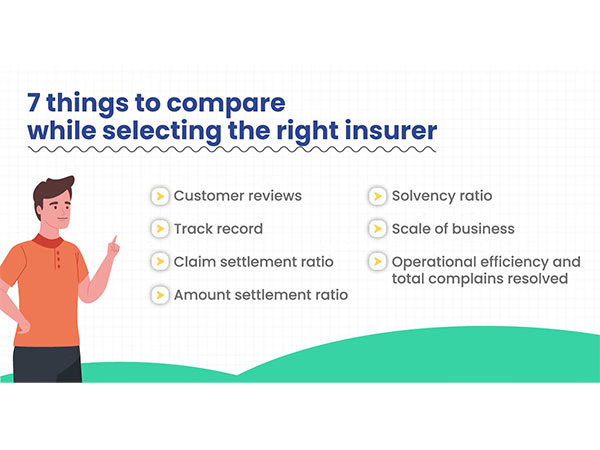

4. Review the Claim Settlement Ratio

A policy is only as good as its claims process.

Always check the insurer’s claim settlement ratio (CSR)—it indicates how many claims are successfully settled out of total received.

A high CSR means greater reliability and smoother claim experiences.

5. Read Customer Reviews and Support Options

Customer feedback offers real insights into an insurer’s reliability. Look for reviews on claim handling, customer service, and online support.

KaroInsure partners only with IRDAI-approved insurers known for transparency and customer satisfaction.

6. Use Trusted Platforms Like KaroInsure

At KaroInsure, you can compare insurance policies from top insurers in India—all in one place.

Our platform ensures:

- Transparent premium breakdowns

- Expert advice from certified professionals

- Easy-to-understand comparisons

This saves you both time and money.

Conclusion

Comparing insurance policies doesn’t have to be complicated. With the right approach, you can confidently find a plan that fits your needs and budget.

In 2025, make smarter financial decisions—compare, understand, and choose the right insurance policy with KaroInsure.

Leave a Reply