The insurance industry is changing rapidly, and much of this transformation is being driven by Gen Z insurance trends in India. This new generation of digital natives is redefining how insurance is bought and managed while challenging old ideas about financial protection. From paperless onboarding to personalized health plans, Gen Z is transforming how insurers connect with young, tech-savvy customers.

1. A Shift From Obligation to Empowerment

For decades, buying insurance in India was seen as a tax-saving obligation. However, Gen Z insurance in India shows a major mindset shift — young people now view insurance as empowerment.

They buy policies because they value independence and control, not just to meet financial requirements. Gen Z sees insurance as a modern financial tool that provides freedom and security.

2. Digital-First Behavior and Instant Access

One of the strongest Gen Z insurance trends is the demand for instant access. This generation expects everything — from quotes to claims — to happen online, quickly and transparently.

They prefer insurers that offer:

- Quick comparisons and instant digital policies

- Chat-based support and mobile-friendly dashboards

- Transparent pricing and paperless claims

This shift reflects how technology is redefining digital insurance for Gen Z in India.

3. Health, Wellness, and Mental Wellbeing

Among emerging insurance trends for young Indians, there’s growing focus on health and mental wellness. Gen Z buyers look beyond hospitalization — they want coverage for preventive care, fitness rewards, and mental health consultations.

Insurance is no longer just about emergencies; it’s about lifestyle protection.

4. Personalization Over One-Size-Fits-All

Gen Z doesn’t want generic plans. They demand flexible, tailored coverage that fits their goals — from freelancers needing income protection to creators insuring their gadgets.

This personalization wave represents the future of Gen Z insurance in India, where customization and clarity replace standard, rigid policies.

5. Trust and Transparency

Trust defines this generation’s relationship with insurance providers. Young Indians carefully read terms, compare reviews, and expect full clarity about exclusions and claims.

Brands that maintain honesty and transparency earn lasting loyalty in this new era of Gen Z-driven insurance.

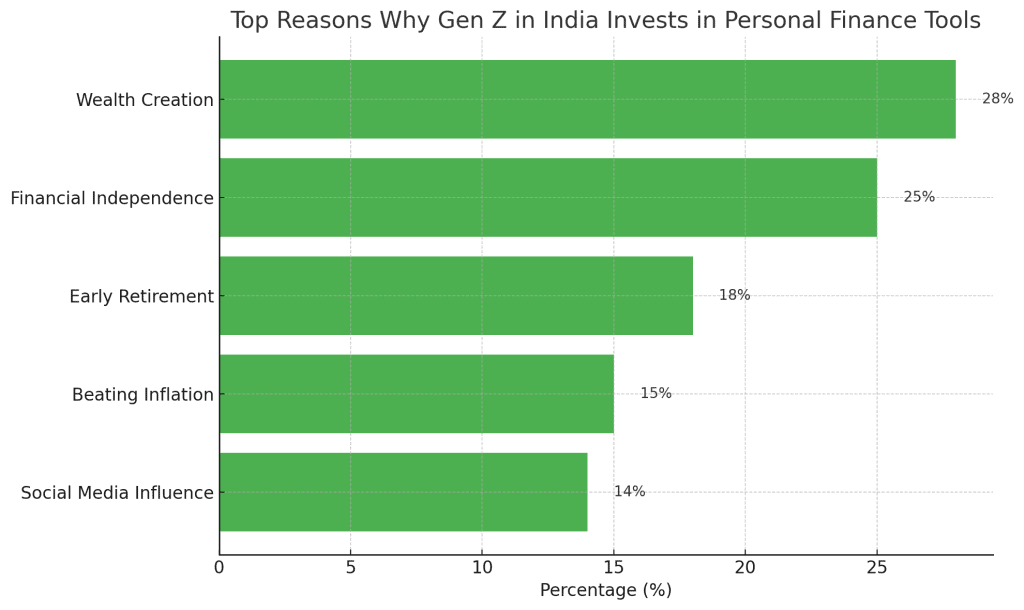

6. Social Media and Financial Awareness

Social media has become one of the most powerful tools shaping Gen Z insurance awareness in India. Through YouTube, Instagram, and finance creators, young buyers learn about premiums, coverage, and benefits in plain, relatable language.

This accessibility has made insurance less intimidating and far more engaging for first-time buyers.

7. Subscription and On-Demand Models

Flexibility remains one of the strongest Gen Z insurance trends in India. Instead of long-term commitments, they prefer pay-as-you-go or on-demand policies.

Examples include:

- Motor insurance based on usage

- Travel policies activated per trip

- Event-based or gadget microinsurance

These models make insurance affordable and relevant for the modern lifestyle.

8. Eco-Conscious and Ethical Choices

Sustainability also influences how young Indians choose their insurers. Companies offering paperless policies, green incentives, and eco-friendly practices attract Gen Z buyers who want their values reflected in their financial choices.

9. Integration With Digital Ecosystems

Insurance today is part of a connected digital lifestyle. Many Gen Z consumers expect integration with health apps, wallets, and wearables — a defining trend in modern insurance for Gen Z.

This seamless connectivity makes policies easier to manage and encourages preventive, data-driven wellness.

10. Balancing Technology and Human Empathy

While Gen Z prefers automation, they still value empathy when it matters most. The best insurers will balance AI-driven convenience with human support during claims or emergencies.

This hybrid approach represents the next phase of Gen Z insurance innovation in India.

Conclusion

The future of India’s insurance market is being reshaped by a generation that values clarity, speed, and personalization. Gen Z insurance trends in India reveal a new era of trust and technology — one where insurers must adapt to win loyalty through simplicity, transparency, and purpose.

For insurers, this is not just a demographic shift — it’s a mindset revolution.

Leave a Reply