In recent years, extreme weather events — floods, cyclones, heatwaves, and landslides — have become alarmingly frequent across the country. As these natural disasters intensify, the climate change impact on home insurance in India is becoming impossible to ignore.

Insurers, homeowners, and policymakers are all rethinking how protection works in a warming world. With increasing property losses and rising claim volumes, climate change impact on home insurance in India is reshaping risk assessment, premiums, and coverage models across the sector.

1. The New Reality: Climate Risks Are Now Financial Risks

Climate change is no longer an environmental issue alone — it’s an economic and financial challenge. India experiences more than 8–10 major climate-related disasters every year, from monsoon floods to prolonged droughts.

This unpredictability is forcing insurers to revise how they price and structure home insurance policies. Traditionally, premiums were based on static risk factors such as location, property type, and claim history. Today, climate-driven events like flash floods or cyclones are central to these calculations.

As a result, the climate change impact on home insurance in India is making policies more dynamic, data-driven, and region-specific.

2. Rising Claims and Premium Adjustments

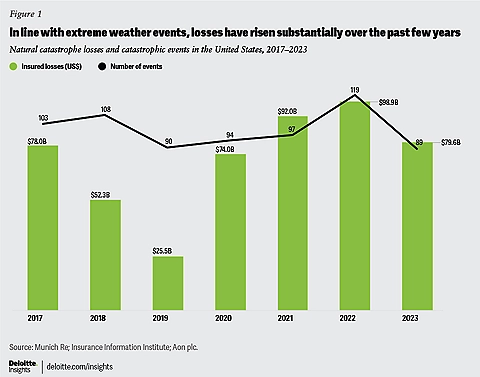

According to industry reports, the frequency of weather-related insurance claims in India has increased by nearly 30% over the past decade. Floods in Chennai, Kerala, and Assam have caused massive property losses, pushing insurers to reassess risk exposure.

Home insurance premiums in flood-prone and coastal regions are already rising. Some insurers are introducing climate-risk pricing, where policy costs depend on vulnerability to extreme weather.

This trend shows that the climate change impact on home insurance in India isn’t theoretical — it’s already affecting how much homeowners pay and what they get covered for.

3. Redefining “Comprehensive Coverage”

Earlier, standard home insurance mainly covered fire, burglary, and accidental damage. Now, insurers are expanding their offerings to include natural disaster coverage, temporary relocation support, and climate-resilience add-ons.

Policies today may include:

- Flood and storm damage protection

- Coverage for landslides and subsidence

- Assistance for temporary housing after a disaster

- Replacement cost coverage for climate-related destruction

Such innovations highlight how climate change impact on home insurance in India is expanding the definition of “protection.”

4. Regional Risk Mapping and Data-Driven Underwriting

Modern insurers increasingly rely on climate data analytics, GIS mapping, and satellite imagery to evaluate regional risks.

For instance, properties located near rivers or low-lying coastal areas are being flagged for higher climate exposure. Similarly, urban centers with outdated drainage systems are being categorized as “high flood-risk zones.”

This integration of data and predictive modeling allows insurers to design smarter, more localized home insurance plans. It’s a clear sign of how climate change is transforming underwriting practices in India’s home insurance industry.

5. Encouraging Climate-Resilient Construction

The climate change impact on home insurance in India extends beyond policies — it’s influencing how homes are built.

Insurers are now offering premium discounts or incentives for homes constructed with eco-friendly materials, elevated foundations, and flood-resistant designs. Builders are encouraged to follow resilience guidelines to make properties insurable at lower costs.

This collaboration between construction and insurance sectors could redefine urban planning and sustainability in India.

6. The Role of Government and Regulation

Public policy is evolving in response to the rising climate risks. The Insurance Regulatory and Development Authority of India (IRDAI) has urged insurers to include climate-related disclosures and expand disaster coverage.

Government-backed programs are also exploring parametric insurance models, where payouts are triggered automatically when a climate event (like rainfall above a certain level) occurs.

Such policy interventions aim to make home insurance more accessible and efficient — especially in vulnerable regions like coastal Maharashtra, Odisha, and the Northeast.

7. The Rise of Parametric and Micro-Insurance

Parametric insurance is one of the most promising innovations in addressing climate change impact on home insurance in India.

Instead of filing traditional claims, homeowners receive a fixed payout when a measurable event occurs (for example, rainfall exceeding 200 mm in 24 hours). This ensures faster compensation and minimal paperwork.

Similarly, micro-insurance products are emerging for low-income homeowners, helping rural and semi-urban families protect small assets from climate-induced damage.

8. Awareness Gap Among Homeowners

Despite rising risks, home insurance penetration in India remains below 1%. Most homeowners still believe “it won’t happen to me” — a mindset that leaves millions financially vulnerable.

Bridging this gap requires better awareness campaigns, simplified digital platforms, and easy-to-understand climate-risk coverage options. As climate patterns worsen, protecting one’s home is no longer optional — it’s essential.

9. Technology and Digital Claims Management

Digitalization is helping insurers process claims faster after climate disasters. Mobile apps, remote surveys via drones, and AI-based claim validation are improving speed and transparency.

For example, after a cyclone, insurers can remotely assess property damage using geotagged photos, making payouts faster and reducing fraud.

Technology is now a critical part of how companies respond to the climate change impact on home insurance in India.

10. Building a Climate-Resilient Future

The future of home insurance in India depends on how well insurers, homeowners, and regulators adapt to the changing climate.

Proactive insurers will use predictive models to anticipate risks, while responsible homeowners will invest in resilient design and adequate coverage. Together, these actions will ensure India’s housing sector can withstand climate challenges.

Ultimately, the climate change impact on home insurance in India is reshaping not just policies — but mindsets. Protection is no longer about reacting to loss; it’s about preparing for it.

Conclusion

Climate change is rewriting the rules of risk, responsibility, and resilience. As India faces more frequent and severe weather events, the need for updated, inclusive, and climate-responsive home insurance policies has become critical.

Understanding the climate change impact on home insurance in India helps homeowners make smarter choices — investing not just in coverage, but in long-term security and sustainability.

Leave a Reply