In a country as diverse and economically varied as India, access to financial protection has long been unequal. Millions of people, especially in rural and low-income segments, have traditionally been excluded from formal insurance systems. But that’s changing fast — thanks to the growing adoption of micro insurance in India.

Micro-insurance is not just a financial product; it’s a social tool designed to protect vulnerable populations from everyday risks like illness, crop loss, accidents, and property damage. As awareness grows and digital access improves, micro insurance in India is emerging as one of the most powerful instruments for inclusive growth and financial stability.

1. What Is Micro-Insurance?

Micro-insurance refers to affordable, low-premium insurance plans designed for individuals with limited income. These products provide protection against common risks such as hospitalization, disability, death, or natural disasters — but at a fraction of the cost of traditional policies.

Unlike standard insurance plans, which often require higher premiums and complex documentation, micro insurance in India focuses on simplicity, accessibility, and inclusivity.

For instance, a micro-health policy might cost less than ₹500 annually while covering essential medical expenses. Similarly, micro-life or accident insurance plans offer small but vital payouts to support families during emergencies.

2. The Growing Need for Micro-Insurance in India

India’s informal and unorganized workforce — farmers, laborers, small shop owners, delivery personnel, and gig workers — makes up over 80% of the total workforce. Most of them live without any insurance coverage.

For these individuals, a single hospitalization, flood, or accident can wipe out years of savings. Micro insurance in India fills this gap by offering financial safety nets that are both affordable and easily accessible.

Rising health costs, climate-related disasters, and the expansion of digital payment systems are accelerating the adoption of these micro policies across both rural and semi-urban India.

3. Government Initiatives Driving Growth

The Government of India and IRDAI (Insurance Regulatory and Development Authority of India) have played a key role in expanding micro insurance in India through inclusive programs such as:

- Pradhan Mantri Jan Suraksha Yojana (PMJSY) – offering accident and life insurance at minimal annual premiums.

- Pradhan Mantri Fasal Bima Yojana (PMFBY) – protecting farmers against crop loss due to floods, droughts, or pests.

- Ayushman Bharat Yojana – providing free or subsidized health insurance for low-income families.

These government-led efforts have not only improved awareness but also encouraged private insurers and fintech startups to design their own micro-insurance products.

4. The Role of Technology and Fintech Platforms

Technology has been a game-changer for micro insurance in India. Digital platforms, mobile apps, and payment gateways have made it possible to reach remote populations that were previously excluded.

For example:

- Mobile wallets and UPI-based apps like Paytm and PhonePe now integrate micro-insurance options.

- Insurtech startups such as Acko, Digit, and Toffee Insurance offer bite-sized, on-demand coverage.

- Blockchain and AI tools are helping insurers verify claims faster and prevent fraud.

This digital-first approach reduces paperwork, lowers operational costs, and makes it convenient for users to buy, renew, and claim policies within minutes.

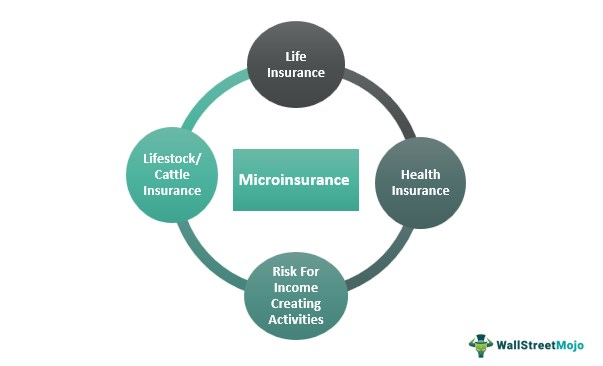

5. Popular Types of Micro-Insurance

Micro insurance in India covers a wide range of everyday risks. Some common types include:

a. Micro Health Insurance

Covers basic hospitalization costs, doctor consultations, and medicines for low-income families.

b. Micro Life and Accident Insurance

Offers financial assistance to families in case of death or disability of the policyholder.

c. Micro Crop and Livestock Insurance

Protects farmers and rural households against crop failure, animal diseases, or natural calamities.

d. Micro Property and Asset Insurance

Provides coverage for small homes, shops, and equipment damaged by fire, flood, or theft.

Each of these plans is designed to make protection simple, affordable, and accessible to everyone.

6. Micro-Insurance for the Gig and Informal Workforce

The rapid rise of India’s gig economy — drivers, delivery partners, freelancers, and platform workers — has created a new need for tailored insurance products.

Companies like Swiggy, Zomato, and Ola now collaborate with insurers to provide micro insurance in India for their partners. These plans typically include accident cover, hospital cash benefits, and income protection.

This trend ensures that India’s growing freelance and gig sector is not left behind in the journey toward financial inclusion.

7. The Role of Microfinance Institutions and NGOs

Microfinance institutions (MFIs) and non-governmental organizations (NGOs) play a crucial role in distributing micro insurance in India to rural areas. They act as intermediaries between insurers and local communities, helping educate people about policy benefits and claim procedures.

Through community-based outreach, these organizations help overcome barriers of trust, literacy, and awareness — especially in regions where digital access is still limited.

8. Challenges Facing Micro-Insurance in India

Despite its growth, micro insurance in India faces several challenges:

- Low awareness: Many potential beneficiaries still don’t know such products exist.

- Complex claims: Limited literacy and documentation issues delay settlements.

- Profitability: Low premiums make it hard for insurers to maintain sustainable operations.

- Distribution gaps: Rural and remote regions still lack last-mile agents or digital access.

Addressing these challenges requires collaboration between the government, insurers, fintechs, and local institutions to improve education, trust, and access.

9. The Future of Micro-Insurance in India

The future looks promising. With digital innovation, regulatory support, and growing social awareness, micro insurance in India is poised to expand rapidly.

Insurers are experimenting with AI-powered risk assessment, usage-based premiums, and hyperlocal coverage models. Moreover, micro-insurance is being linked with social security, financial literacy, and sustainable development goals (SDGs).

As financial inclusion deepens, micro-insurance could soon become as common as mobile banking — ensuring that every individual, regardless of income, has access to financial protection.

10. Why Micro-Insurance Matters

Micro-insurance is not charity — it’s empowerment. It transforms how vulnerable individuals deal with uncertainty, giving them dignity, confidence, and the ability to recover from setbacks.

For India, where millions still live one emergency away from poverty, micro insurance in India represents hope — a bridge between economic vulnerability and financial security.

Conclusion

The rise of micro insurance in India marks a significant step toward financial inclusion and resilience. It is helping millions of low-income households, gig workers, and small business owners safeguard their future.

As climate risks, health emergencies, and income instability rise, micro-insurance ensures that protection isn’t a privilege for a few — it’s a right for everyone.

Leave a Reply