In India, Micro, Small, and Medium Enterprises (MSMEs) form the beating heart of the nation’s economy. From local manufacturers and startups to service-based firms, MSMEs contribute over 30% to India’s GDP and employ millions across diverse sectors. Yet, many of these businesses remain vulnerable to unforeseen risks like property damage, fire, cyberattacks, or sudden legal liabilities.

That’s where Business Insurance for MSMEs comes into play. It acts as a financial shield, protecting small businesses from losses that can disrupt operations or cause permanent closure. Let’s dive deep into how business insurance empowers MSMEs to stay resilient, competitive, and future-ready.

1. Understanding Business Insurance for MSMEs

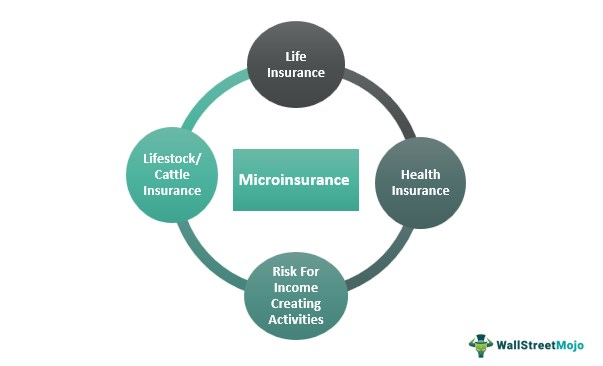

Business insurance is a comprehensive policy designed to safeguard small and medium enterprises from potential financial losses caused by accidents, disasters, theft, or liability claims.

A typical Business Insurance for MSMEs covers:

- Property & Fire Insurance – Protects business assets like buildings, machinery, and stock against fire, explosion, or natural calamities.

- Liability Insurance – Covers third-party damages or injuries caused during business operations.

- Health & Employee Insurance – Offers health coverage and benefits to employees, boosting morale and retention.

- Marine & Transit Insurance – Covers goods in transit against damage, loss, or theft.

- Cyber Risk Insurance – Secures businesses from data breaches, ransomware, and cyber fraud.

Business insurance isn’t just a policy; it’s a promise that your enterprise can recover and rebuild even after unexpected setbacks.

2. Why Business Insurance Is Crucial for MSMEs

Despite being growth drivers, most MSMEs in India operate on tight budgets and limited resources. A single accident, lawsuit, or fire can lead to massive losses. Having Business Insurance for MSMEs ensures stability and protection.

Key Reasons It’s a Game-Changer:

- Risk Mitigation: Shields your assets and finances from unpredictable events.

- Business Continuity: Keeps operations running even after an incident.

- Legal Protection: Covers legal expenses from third-party claims.

- Employee Security: Builds loyalty by ensuring healthcare and safety benefits.

- Credibility: Insured businesses are more trustworthy to investors, clients, and financial institutions.

3. Major Benefits of Business Insurance for MSMEs

a) Protection Against Property & Asset Loss

Natural disasters, fires, or accidents can destroy years of hard work overnight.

Fire and Property Insurance ensures compensation for such damages, letting MSMEs rebuild without financial strain.

b) Coverage for Legal & Third-Party Liabilities

If your product or service accidentally causes harm to someone, you could face legal claims.

Liability Insurance covers legal costs, settlements, and compensation, saving MSMEs from court-induced financial crises.

c) Employee Health and Welfare

Your employees are your greatest asset. Health Insurance for employees enhances job satisfaction and loyalty while ensuring productivity isn’t lost due to medical emergencies.

d) Protection for Goods in Transit

For MSMEs dealing with logistics or exports, Marine Insurance offers coverage for goods lost or damaged during transportation — essential for smooth supply chain management.

e) Cyber Protection for Digital MSMEs

With the rise of digital payments and e-commerce, small businesses are now prime targets for cyber threats.

Cyber Insurance protects MSMEs against data breaches, ransomware, and fraudulent digital transactions.

f) Enhancing Business Reputation

An insured business demonstrates reliability. Clients and investors view insurance as a sign of professionalism and accountability.

4. Real-Life Example: How Insurance Saved an MSME

Consider a small textile manufacturer in Surat. A sudden fire destroyed its warehouse worth ₹25 lakh. Fortunately, the owner had Fire Insurance under a business insurance policy. Within weeks, the claim helped him recover most of his losses and restart operations.

Without insurance, that business would’ve shut down permanently — a fate shared by thousands of uninsured MSMEs.

5. Types of Business Insurance MSMEs Should Consider

Here’s a breakdown of the most relevant insurance types for small and medium enterprises:

| Type of Insurance | Purpose | Ideal For |

|---|---|---|

| Property & Fire Insurance | Covers damages due to fire, theft, or disasters | Factories, offices, warehouses |

| Liability Insurance | Protects against third-party injury/damage claims | Manufacturers, service providers |

| Health Insurance | Covers medical expenses for employees | All MSMEs with staff |

| Marine Insurance | Protects goods in transit (road/sea/air) | Traders, exporters, logistics |

| Cyber Insurance | Covers data loss, ransomware, and hacking | IT, e-commerce, fintech MSMEs |

| Business Interruption Insurance | Compensates for loss of income due to halted operations | Manufacturing and retail units |

Choosing the right mix ensures comprehensive protection tailored to your MSME’s needs.

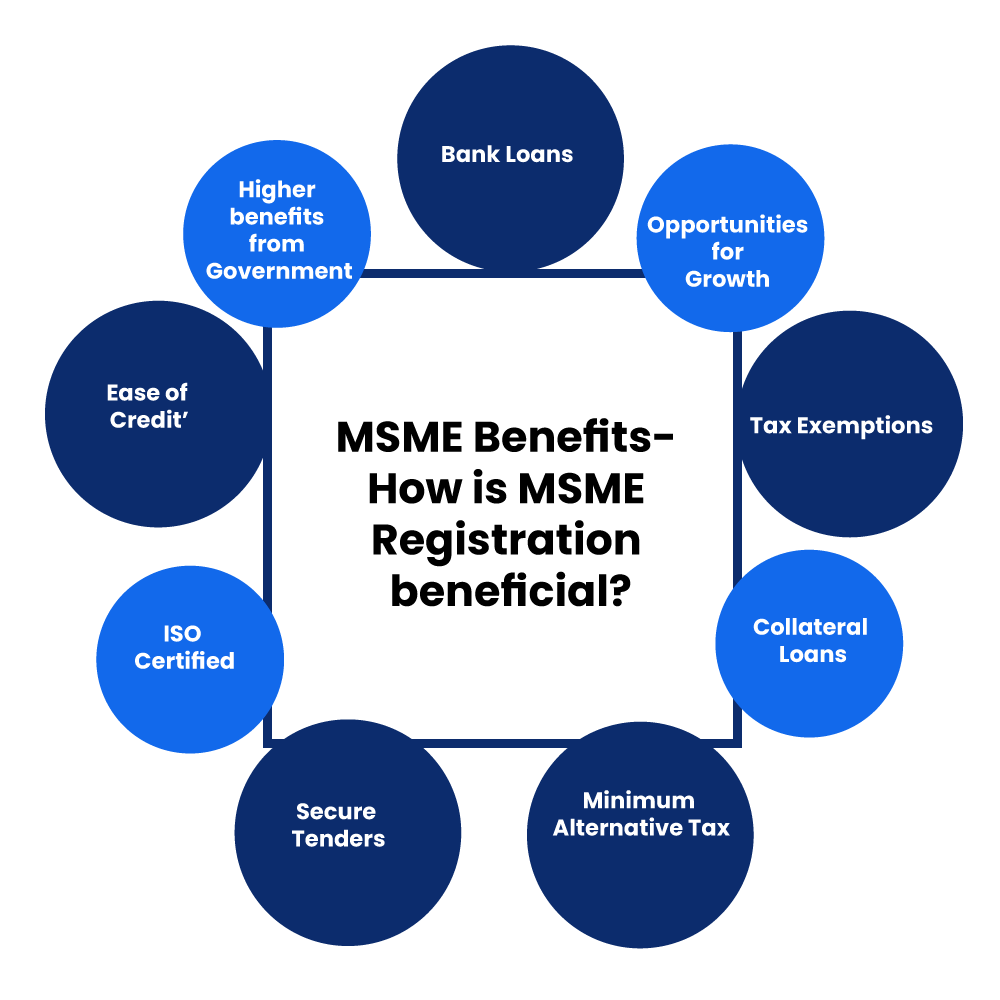

6. Government Support for MSME Insurance

The Indian government actively encourages MSMEs to adopt insurance for better resilience.

Some key initiatives include:

- SIDBI & MSME Schemes: Offering subsidized premium rates for small businesses.

- National Insurance Awareness Programs: Educating entrepreneurs about risk management.

- Credit-Linked Insurance Plans: Bundled with MSME loans to safeguard both lenders and borrowers.

These initiatives aim to strengthen MSME confidence and reduce financial vulnerability.

7. How to Choose the Right Business Insurance for MSMEs

Selecting the right policy requires assessing your business risks and coverage needs.

Quick Checklist for MSMEs:

- Evaluate potential risks (fire, theft, cyberattack, etc.)

- Identify assets and employees to be covered

- Compare multiple insurance providers for rates and benefits

- Check claim settlement ratios and reviews

- Customize your policy with add-ons suited to your operations

- Consult a licensed insurance advisor or use trusted platforms like KaroInsure

A well-planned insurance strategy ensures your MSME isn’t caught off-guard by sudden losses.

8. Why Choose KaroInsure for MSME Business Insurance

At KaroInsure, we simplify insurance for businesses of all sizes. Our team understands the challenges MSMEs face and provides tailored solutions across motor, health, fire, marine, and life insurance.

What Makes KaroInsure Different:

- Personalized insurance plans for every MSME sector

- Fast claim support and transparent processing

- Expert advice to minimize business risks

- Affordable premiums with maximum coverage

KaroInsure’s goal is to empower MSMEs to grow fearlessly, knowing their future is protected.

Conclusion

In an unpredictable world, business insurance is not an expense — it’s a survival tool. Business Insurance for MSMEs ensures your enterprise stands firm against disasters, liabilities, or economic shocks. Whether you’re a startup or a small manufacturer, being insured gives you peace of mind and a competitive edge.