In recent years, the financial landscape has undergone a remarkable transformation. From online shopping to education, the Buy Now, Pay Later (BNPL) model has revolutionized how people make payments. Now, this trend is entering a new domain — insurance premiums. The idea of paying your insurance premium in easy monthly installments (EMIs) is gaining popularity across India and beyond.

But is this just a passing trend, or does it represent the future of insurance payments? Let’s dive deep into what BNPL premiums are, how they work, their pros and cons, and what they mean for the future of the insurance sector.

Understanding the Buy-Now-Pay-Later (BNPL) Model

The BNPL model allows customers to buy products or services immediately and pay for them later in flexible installments. It’s like a modern twist on credit — easy to access, transparent, and interest-free in many cases.

When applied to insurance, BNPL means that instead of paying the entire premium at once, policyholders can split their premium into multiple EMIs. This flexibility helps individuals manage their cash flow better while still maintaining adequate insurance coverage.

For example, if an annual health insurance premium costs ₹24,000, instead of paying the full amount upfront, a policyholder can choose to pay ₹2,000 per month for 12 months through a BNPL or EMI option.

Why the Shift Toward EMI-Based Premiums?

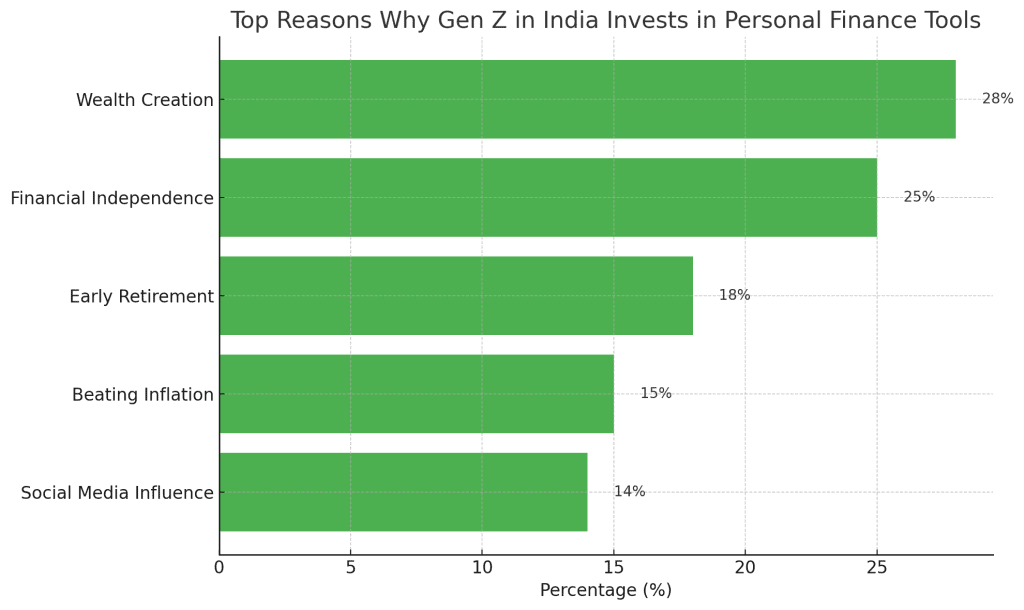

The demand for BNPL insurance premiums is driven by several key factors:

1. Financial Flexibility

Many consumers, especially millennials and Gen Z, prefer spreading out large payments. The EMI option for insurance aligns with their budgeting habits, making insurance more accessible without financial strain.

2. Increasing Insurance Awareness

As awareness of health, life, and vehicle insurance grows, more individuals want coverage — but affordability remains a challenge. EMI-based payments bridge this affordability gap.

3. Technological Innovation

Insurtech companies are making insurance simpler, faster, and more digital. Integrating Buy Now Pay Later Premiums options into apps and websites allows for a smoother customer experience and encourages more people to stay insured.

4. Economic Pressures

Post-pandemic financial constraints have led consumers to seek flexible payment options. Paying in installments helps them maintain important policies even when budgets are tight.

How EMI Options for Insurance Work

The process of converting your insurance premium into EMIs is straightforward:

- Choose the Policy: Select your insurance type (health, motor, term life, etc.).

- Select Payment Option: At checkout, choose the EMI or BNPL option instead of a lump sum payment.

- Verify and Approve: A quick credit check (if applicable) or verification is done.

- Payment Schedule: Your premium is automatically divided into equal monthly installments, often with little to no interest.

Many insurers partner with fintech platforms or banks to offer these EMI options. For instance, companies like Policybazaar, Paytm Insurance, and Bajaj Finserv already provide BNPL premium facilities.

Advantages of Buy-Now-Pay-Later Premiums

1. Makes Insurance Affordable

The most obvious benefit is affordability. People who couldn’t afford to pay large annual premiums can now easily manage monthly payments.

2. Expands Insurance Penetration

India has one of the lowest insurance penetration rates in the world. EMI options can change that by encouraging more people to buy insurance.

3. Encourages Timely Renewals

When premiums are easier to pay, policyholders are less likely to let their policies lapse. This ensures continuous coverage and peace of mind.

4. Boosts Digital Adoption

As the insurance industry goes digital, BNPL integrations make purchasing policies online more convenient and user-friendly.

5. Attracts Younger Demographics

Younger consumers prefer flexibility and digital-first solutions. EMI-based premiums align perfectly with their expectations and lifestyle.

Challenges and Risks of Buy Now Pay Later Premiums

While the EMI model sounds promising, it’s not without its downsides.

1. Hidden Costs

Some insurers or fintech partners may charge processing fees or interest, which can increase the total cost over time.

2. Dependence on Creditworthiness

Not everyone qualifies for BNPL or EMI options. People with poor credit scores may face rejection or higher charges.

3. Risk of Over-Leveraging

Easy monthly payments can sometimes lead consumers to over-commit financially, buying multiple policies they can’t sustain in the long run.

4. Operational Complexity

For insurers, integrating BNPL systems means extra coordination with payment gateways and financial partners — which can be challenging for traditional insurance companies.

BNPL Insurance in India: Current Trends

The concept of BNPL insurance is still evolving in India, but adoption is rising fast.

Here are some ongoing trends:

- Health insurance is leading the BNPL charge, as medical policies often have higher premiums.

- Fintech startups are partnering with insurers to offer instant EMI conversions.

- Zero-cost EMI plans are becoming a popular marketing tool for attracting customers.

- Regulators like IRDAI are monitoring the model to ensure consumer protection and transparency.

With the government pushing for “Insurance for All by 2047”, BNPL can play a critical role in expanding coverage to lower-income and rural populations.

Global Perspective: BNPL in Insurance Worldwide

In countries like the US, UK, and Australia, BNPL models are already well integrated into insurance. Many consumers pay for car or health insurance through monthly subscription-style plans rather than one-time premiums.

This global trend indicates that EMI-based insurance is not just a short-lived innovation — it’s part of a broader movement toward flexible financial ecosystems. As India continues to embrace digital payments and financial inclusion, it’s likely that similar adoption patterns will emerge domestically.

The Future of EMI Options in Insurance

The future of insurance payments looks set to evolve around flexibility, accessibility, and technology. With more insurers collaborating with fintech players, BNPL premiums could become a standard payment method rather than a special feature.

In the coming years, we might see:

- Subscription-based insurance models where policies renew automatically each month.

- AI-driven affordability scoring to determine EMI eligibility instantly.

- Dynamic payment plans based on usage or income.

- Integration with UPI and digital wallets for seamless automated payments.

Conclusion

The concept of Buy-Now-Pay-Later premiums is more than just a payment trend — it’s a financial innovation that makes insurance accessible to millions. While challenges like credit checks and hidden fees remain, the overall benefits — affordability, inclusivity, and convenience — are undeniable.

As the digital economy continues to grow, EMI-based premiums could well become the future of insurance. By making insurance easier to buy, maintain, and renew, this model has the potential to transform financial protection for everyone.