In India, insurance is often treated like a low-priority item on the financial checklist — something to think about “later.” Despite rising awareness, only a fraction of the Indian population has adequate life or health coverage. According to IRDAI data, India’s insurance penetration remains significantly lower compared to global averages.

But why do so many Indians delay buying insurance even when they know it’s important? The answer lies not just in income or affordability but in psychological behavior, cultural attitudes, and financial perceptions that shape how Indians make money-related decisions.

This article explores the psychology behind why Indians delay buying insurance, the emotional and social barriers involved, and what can be done to change this mindset.

1. The Cultural Mindset: “It Won’t Happen to Me”

One of the strongest psychological factors influencing financial decisions in India is optimism bias — the belief that negative events are less likely to happen to oneself.

Many people think accidents, illnesses, or untimely deaths are distant possibilities that only affect others. This overconfidence creates a false sense of security. When life is going well, people assume it will continue that way, leading them to postpone crucial steps like buying insurance.

Culturally, Indian families often rely on collective support systems — parents, siblings, or extended relatives — to provide financial help in emergencies. This informal safety net reinforces the belief that formal insurance is unnecessary.

However, as nuclear families and independent lifestyles grow, this traditional backup system is fading fast. Yet, the “it won’t happen to me” mindset continues to delay timely financial protection.

2. Lack of Financial Literacy and Understanding

Another major reason Indians delay insurance is poor financial literacy. Many people still see insurance purely as a tax-saving tool, not as a financial safety instrument.

During tax season, insurance agents experience a surge in policy sales. But once the financial year ends, interest drops sharply. This behavior shows that insurance is often seen as an obligation — not a necessity.

Most Indians do not fully understand:

- The difference between term plans and investment-linked plans

- The importance of early purchase for lower premiums

- The compounding benefits of long-term health coverage

Without this understanding, they either delay decisions or buy the wrong products.

Improving financial education in schools, workplaces, and through media can play a vital role in changing these misconceptions.

3. Procrastination and Emotional Avoidance

Procrastination is a universal human behavior, but it takes a deeper form when it comes to financial matters. Buying insurance requires one to think about illness, accidents, and death — topics that trigger discomfort and fear.

For many, avoiding emotional discomfort feels easier than facing reality. So they postpone buying insurance with excuses like:

- “I’ll buy it when I start earning more.”

- “I’m still young and healthy.”

- “Let me first finish paying my loans.”

This emotional avoidance leads to decision paralysis, where people keep delaying action despite knowing it’s the right choice.

Behavioral finance studies show that individuals often prioritize instant gratification (like spending on travel, gadgets, or dining out) over long-term security, because the benefits of insurance are intangible and in the future.

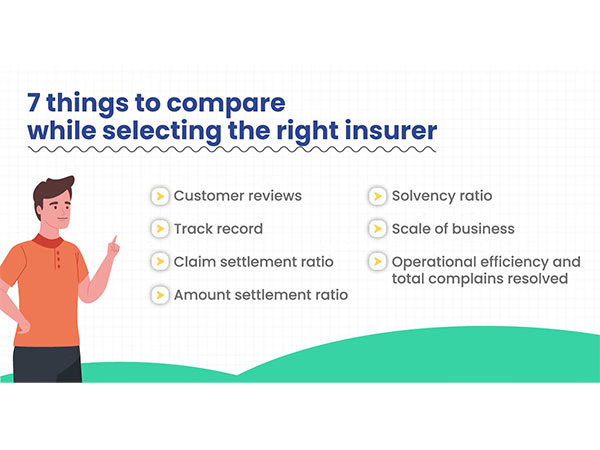

4. The Complexity of Insurance Products

Insurance documents are often filled with jargon — premiums, exclusions, riders, maturity values, and waiting periods. The sheer complexity discourages people from making quick decisions.

Many Indians feel overwhelmed by too many choices and confusing terms. This leads to what psychologists call “choice overload.” When faced with too many options, people tend to avoid making any decision at all.

Also, the lack of trust in agents or online platforms adds to the hesitation. Many fear being misled or “trapped” in long-term commitments that don’t serve their interests.

The solution lies in transparency and simplicity — insurers and financial advisors should explain policies in clear, relatable language with real-life examples.

5. Social Influence and Peer Behavior

In India, financial decisions are deeply influenced by what others around us do. If peers, colleagues, or family members are not actively buying insurance, individuals feel less urgency to do so themselves.

There’s also a tendency to follow collective norms rather than independent thinking. For instance, when people see friends investing in gold, real estate, or mutual funds, they tend to do the same — even if insurance would provide better security for their situation.

This herd mentality extends to how people perceive the “right time” to buy insurance. Often, they wait until marriage, parenthood, or a health scare before taking action — by which time premiums have increased, or coverage options are limited.

Changing this behavior requires positive role models and public awareness campaigns that normalize early insurance adoption.

6. Income Priorities and Misplaced Spending

Even when people can afford insurance, they often prioritize short-term expenses over long-term protection. Modern consumerism encourages spending on lifestyle upgrades rather than savings or safety nets.

Many young professionals prefer to buy cars, smartphones, or fashion items before considering insurance. Since insurance doesn’t give visible or immediate returns, it feels less rewarding compared to tangible purchases.

This is known as “present bias” — a cognitive bias where people overvalue current pleasures and undervalue future security.

The result: individuals delay purchasing insurance until it becomes absolutely necessary — often after witnessing a medical emergency or financial loss in their circle.

7. Trust Deficit and Negative Past Experiences

Trust plays a crucial role in financial decision-making. Many Indians have grown skeptical due to past experiences of claim rejections, hidden charges, or poor customer support.

Stories of delayed hospital reimbursements or rejected life insurance claims spread quickly through word-of-mouth, creating fear and hesitation.

Insurers and agents must rebuild confidence through:

- Clear communication about inclusions and exclusions

- Transparent claims processes

- Consistent customer support and digital accessibility

Trust-building is a slow process, but it’s essential to encourage people to make timely insurance decisions.

8. Generational and Psychological Gaps

Older generations often believed in saving through fixed deposits, gold, or real estate — tangible assets that could be “seen and touched.” Insurance, being an intangible product, didn’t appeal to their traditional financial mindset.

On the other hand, younger generations, though more aware, are often caught between financial aspirations and lifestyle goals. While they understand the importance of insurance, many feel they can “do it later” once their income stabilizes.

Bridging this gap requires financial storytelling — real-life case studies showing how insurance protects families from financial disasters and how early investment makes a difference.

9. Changing Trends: A Shift Toward Awareness

Despite these psychological and social barriers, the mindset is slowly changing. The COVID-19 pandemic served as a wake-up call, reminding people of life’s unpredictability and the importance of financial preparedness.

Post-pandemic data shows a sharp rise in health and term insurance purchases, especially among urban and tech-savvy populations. Digital insurance platforms have simplified comparisons, claims, and renewals — making it easier for people to make informed decisions.

Still, rural and semi-urban areas need continued awareness programs, simplified policies, and trust-building initiatives to ensure inclusivity in India’s insurance ecosystem.

10. How to Overcome the Delay and Act Now

If you’ve been delaying buying insurance, consider these steps:

- Start early – The earlier you buy, the lower your premium and the longer your coverage.

- Understand your needs – Evaluate your family’s financial goals, health history, and income stability.

- Choose simplicity – Opt for transparent, easy-to-understand policies with clear benefits.

- Set reminders – Treat insurance renewal like paying a utility bill — essential and non-negotiable.

- Consult experts – Seek advice from certified financial planners, not just sales agents.

Taking these steps can help you secure financial stability and peace of mind for yourself and your family.

Conclusion

The delay in buying insurance among Indians is not merely a financial issue — it’s a psychological and cultural phenomenon. Factors like optimism bias, procrastination, social influence, and emotional avoidance all play a role in this behavior.

However, with rising awareness, better digital platforms, and improved transparency, Indians are gradually recognizing that insurance is not an expense — it’s an investment in financial security and peace of mind.

The key lies in understanding the value of protection before a crisis forces you to. As the saying goes, “The best time to buy insurance was yesterday; the next best time is today.”