Life is unpredictable, and medical emergencies often arrive without warning. In such situations, the last thing you want to worry about is arranging money for hospital expenses. This is where cashless health insurance hospitals play a crucial role — allowing you or your loved ones to get treated without the stress of immediate payments.

In India, where healthcare costs are rising every year, cashless hospitalization has become an essential feature of health insurance. It ensures that you receive timely care while your insurer directly settles the hospital bills. With KaroInsure, finding the right plan with a wide network of cashless hospitals becomes simple and transparent.

What Are Cashless Health Insurance Hospitals?

Cashless health insurance hospitals are medical institutions that have a tie-up (network relationship) with your insurance company. When you or a family member are admitted to one of these network hospitals, you don’t need to pay hospital bills upfront. Instead, your insurer settles the payment directly with the hospital — as per the terms of your policy.

For example, if you have a KaroInsure-recommended policy, you can visit one of the insurer’s network hospitals, show your health card, and get treatment without paying from your pocket (except for non-covered items like personal care or optional facilities).

To learn more about how insurance claims work, you can also read our guide on Easy Guide to Claim Settlement.

How Cashless Hospitalization Works

Many people think cashless claims are complicated, but the process is straightforward if you follow the right steps.

- Choose a Network Hospital

Before admission, check your insurer’s list of network hospitals. KaroInsure provides easy online access to these lists so you can locate one nearby. - Show Your Health Card

Present your insurance card or policy number at the hospital’s insurance desk. This step verifies your policy details. - Get Pre-Authorization

The hospital sends a pre-authorization form to the insurance company or the Third-Party Administrator (TPA) for approval. - Receive Treatment Without Paying Upfront

Once approved, you can undergo treatment or surgery without paying any hospital bills directly. - Discharge and Final Settlement

After discharge, the hospital sends the final bill to the insurer, who pays the approved amount directly to the hospital.

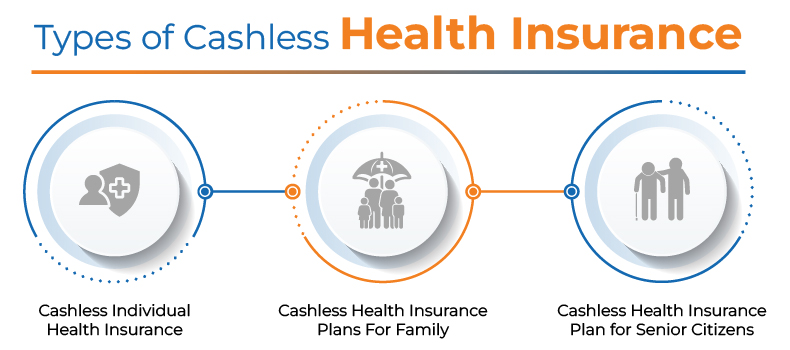

Types of Cashless Hospitalization in India

There are two main ways to avail of cashless treatment in India.

Planned Hospitalization

If you know you’ll be hospitalized for a scheduled procedure such as surgery or maternity care, you can inform your insurer 48–72 hours before admission. This allows enough time to process approvals smoothly.

Emergency Hospitalization

In emergencies, you can go directly to a network hospital, where the hospital will quickly contact the insurer for urgent approval. KaroInsure helps streamline this process through real-time support and coordination.

For maternity-related cases, you can explore our post on Maternity Insurance: What’s Covered and What Isn’t.

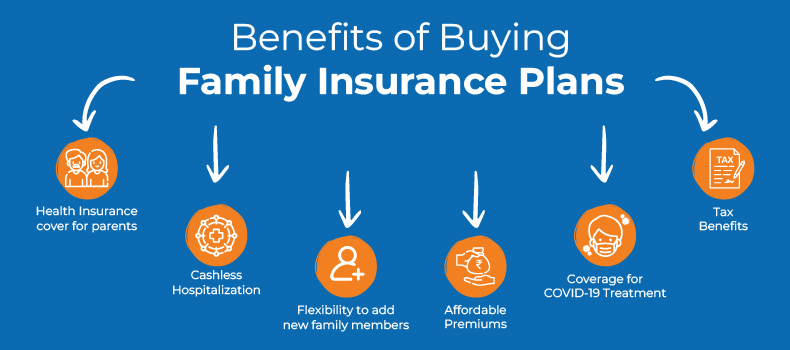

Benefits of Cashless Health Insurance Hospitals

Choosing a plan with cashless hospitalization offers several benefits:

- No financial stress during emergencies.

- Wide network of hospitals across India.

- Minimal paperwork and quick approvals.

- Quality medical care at verified institutions.

- Transparent billing and settlement.

- 24×7 support from insurers and TPAs.

These benefits make cashless health insurance hospitals an essential part of modern healthcare for Indian families.

Key Points to Remember Before Using Cashless Facilities

- Always check if your hospital is part of your insurer’s network before admission.

- Verify the coverage limit for room rent, surgery, or specialist fees.

- Keep your insurance ID card or policy number handy.

- Inform the insurer or TPA as early as possible in planned cases.

- Maintain copies of all documents for reference.

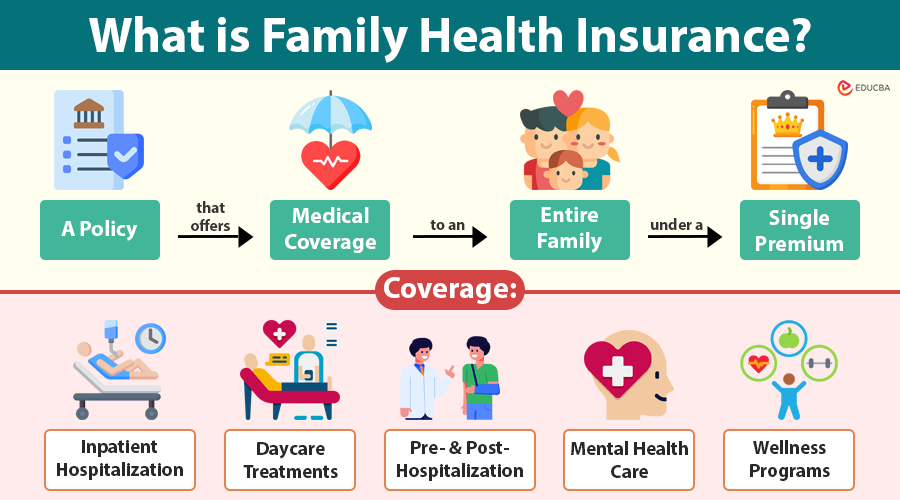

To explore more about family coverage, check our article on Benefits of Family Health Plans.

KaroInsure’s Role in Simplifying Cashless Hospitalization

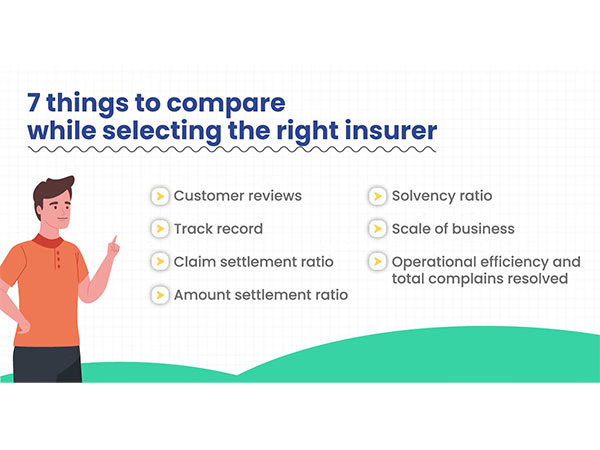

KaroInsure works with top IRDAI-approved insurers in India to ensure customers get policies that offer maximum hospital network coverage. With KaroInsure, you can:

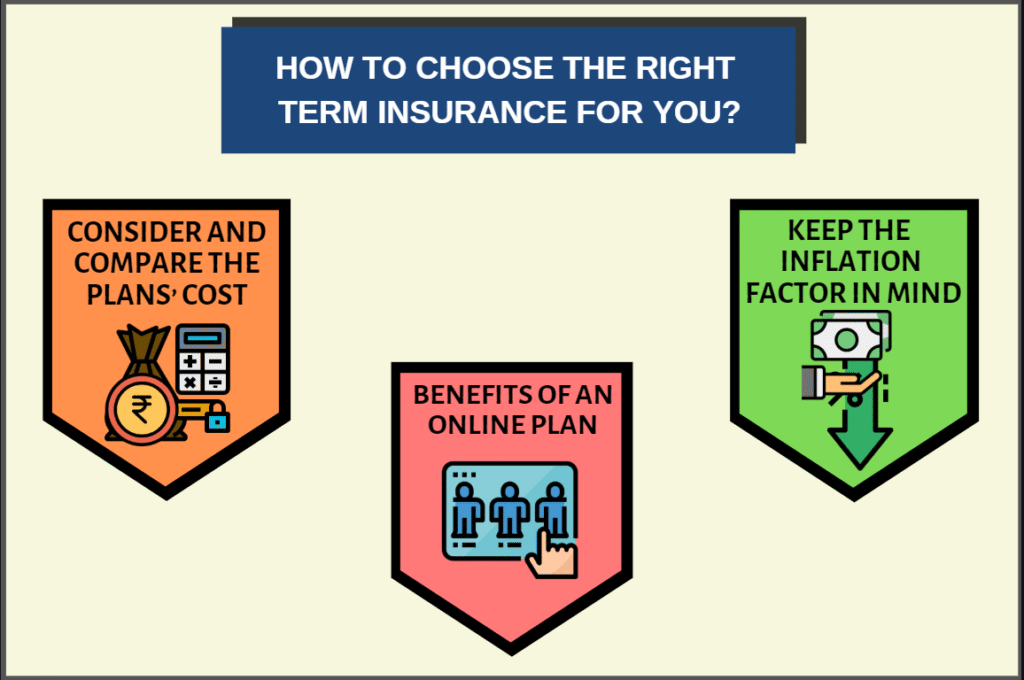

- Compare cashless health insurance plans side by side.

- View hospitals in your city covered under each plan.

- Understand exclusions, room rent limits, and rider options.

- Get expert guidance for filing and tracking claims.

Whether you live in Delhi, Mumbai, or Panipat, KaroInsure ensures you always have a reliable cashless hospital near you.

Common Myths About Cashless Hospitals

Myth 1: All hospitals offer cashless facilities.

Fact: Only network hospitals tied with your insurer can provide cashless treatment.

Myth 2: Cashless claims take days to approve.

Fact: With proper documentation, approvals often come within a few hours.

Myth 3: You don’t need to inform your insurer.

Fact: Always inform or pre-authorize before hospitalization for a smoother process.

Conclusion

Medical emergencies are unpredictable, but your finances don’t have to be. Choosing a plan with access to cashless health insurance hospitals ensures that you receive timely care without worrying about payments.

With KaroInsure, you can compare, select, and buy the best health insurance plans in India — with wide network coverage and transparent claim support. When health is your priority, financial peace should come automatically.