Fires can cause devastating losses to homes, shops, offices, warehouses, and factories across India. To safeguard against such risks, individuals and businesses must understand the nature and scope of fire insurance. Through its platform, KaroInsure connects Indian clients with IRDAI-approved fire insurance policies from leading insurers, ensuring protection for residential, commercial, industrial, and agricultural assets.

Understanding Fire Insurance

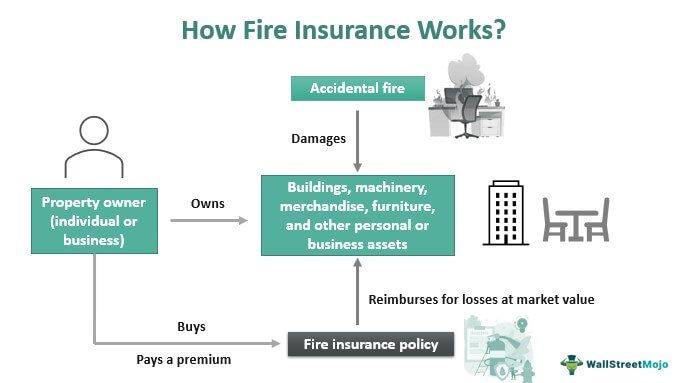

Fire insurance is a form of property insurance designed to provide financial compensation in the event of damage or destruction caused by fire. The nature and scope of fire insurance make it one of the most important risk management tools for Indian households and businesses. It ensures that the insured is indemnified for the actual loss sustained, without enabling profit from the event.

Nature and Scope of Fire Insurance — The Nature of Fire Insurance

When analyzing the nature and scope of fire insurance, it is important to first understand its core characteristics.

- Contract of Indemnity: Fire insurance is based on the principle of indemnity, which ensures that the insured is compensated only for the actual loss suffered.

- Conditional Contract: The policy is valid only if the insured abides by the terms and conditions, such as timely premium payment and truthful disclosure.

- Personal Contract: Fire insurance is a contract between the insurer and the insured. If the ownership of the property changes, the contract does not automatically transfer.

- Contract of Utmost Good Faith: Both parties must disclose all material facts honestly. Misrepresentation can result in claim denial.

- Insurable Interest: The insured must have a legal or financial interest in the property at the time of both taking the policy and at the time of loss.

These elements define the nature of fire insurance, making it a fair and protective agreement rather than a profit-making tool.

The Scope of Coverage

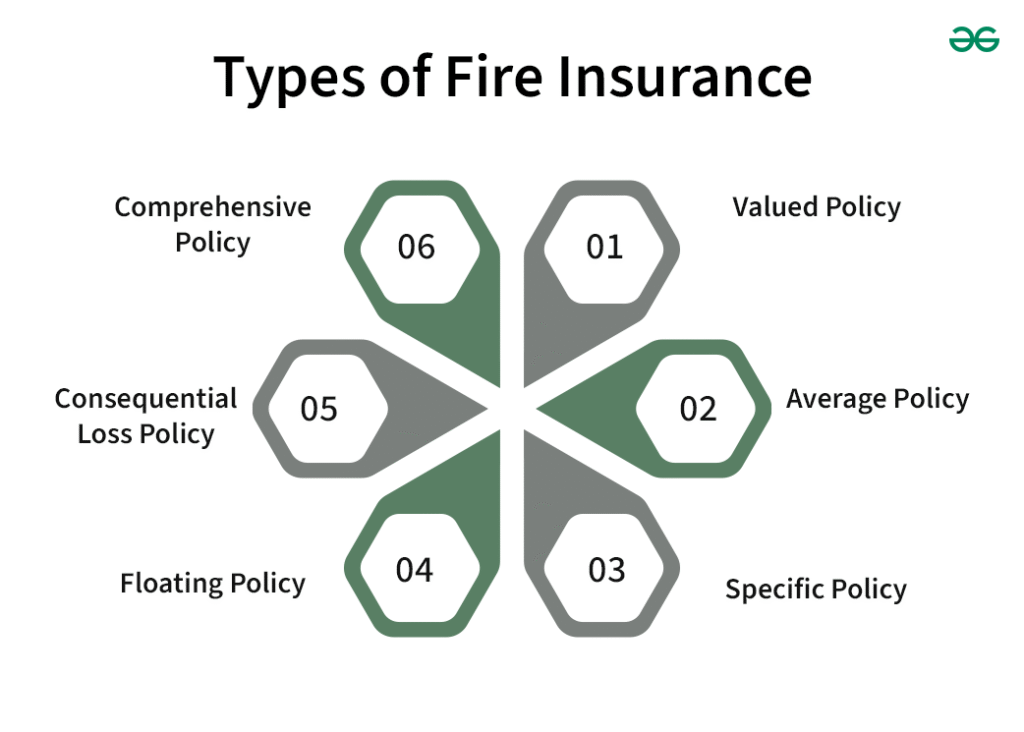

The scope of fire insurance determines what risks and assets can be covered under the policy. In India, the scope includes:

- Residential Property: Coverage for homes, flats, and household contents.

- Commercial Property: Shops, offices, warehouses, and stock-in-trade.

- Industrial Property: Factories, plants, machinery, and raw materials.

- Agricultural Assets: Farmhouses, produce storage, and agricultural equipment.

- Special Coverage: Add-ons like earthquake, explosion, lightning, riots, strikes, and malicious damage.

Through KaroInsure, Indian clients can evaluate different insurers and customize the scope of their fire insurance according to their needs.

Exclusions

While understanding the nature and scope of fire insurance, it is equally important to know what is excluded. Common exclusions include:

- Damage caused by war, invasion, or nuclear risks

- Fire resulting from negligence or deliberate actions

- Gradual wear and tear of property

- Loss of valuable items like cash, jewelry, or documents unless specifically insured

KaroInsure ensures that clients are fully aware of exclusions so that expectations are managed before purchasing a policy.

Importance for Indian Clients

The nature and scope of fire insurance highlight its critical role in financial protection for Indian households and businesses. Its importance lies in:

- Asset Protection: Safeguarding valuable assets from fire-related risks.

- Business Continuity: Preventing disruption to operations after fire incidents.

- Peace of Mind: Offering security to families and business owners.

- Regulatory Compliance: Many businesses are required by lenders or regulators to hold valid fire insurance.

KaroInsure provides easy access to reliable policies, ensuring Indian clients benefit from affordable and adequate protection.

Claim Process in India

A key part of the nature and scope of fire insurance is how claims are settled. The standard claim process in India includes:

- Notify the insurer immediately after a fire incident

- File a detailed report of damages with supporting documents

- Submit fire brigade and police reports, if applicable

- Allow surveyors appointed by the insurer to assess losses

- Receive compensation based on the principle of indemnity

KaroInsure supports its clients throughout the claim process, making it efficient and transparent.

Add-On Options

The scope of fire insurance can be expanded with add-ons, giving clients extra protection. Popular add-ons in India include:

- Loss of Rent: Compensation if the insured property becomes uninhabitable.

- Debris Removal: Coverage for the cost of clearing damaged property.

- Alternative Accommodation: Temporary housing expenses for families.

- Business Interruption Cover: Compensation for loss of income after fire-related damages.

KaroInsure helps Indian clients evaluate and select these add-ons to maximize coverage benefits.

Tips for Indian Clients

To make the most of the nature and scope of fire insurance, Indian clients should:

- Assess the correct value of assets before buying insurance

- Avoid under-insurance or over-insurance

- Disclose all material facts honestly

- Compare multiple insurers through KaroInsure before finalizing

- Maintain updated documentation for claims

These steps ensure smoother claim settlement and adequate financial protection.

Conclusion

In conclusion, the nature and scope of fire insurance cover its legal principles, coverage area, exclusions, and importance in protecting assets. Fire insurance is a vital tool for Indian individuals, homeowners, and businesses, ensuring financial stability in case of fire-related incidents. Through its trusted platform, KaroInsure connects Indian clients with leading insurers, helping them understand the nature and scope of fire insurance, select the right policy, and manage claims efficiently. By doing so, KaroInsure ensures that clients safeguard their property and achieve peace of mind in an uncertain world.