Health insurance in India is undergoing a major transformation. With new IRDAI regulations in effect, policies have become more customer-friendly. Waiting periods are shorter, entry age restrictions are easing, and claim settlement processes are more transparent. For individuals and families, 2025 is a great time to secure health coverage — but it’s also important to understand what these changes mean before you buy.

Why the New Guidelines Matter

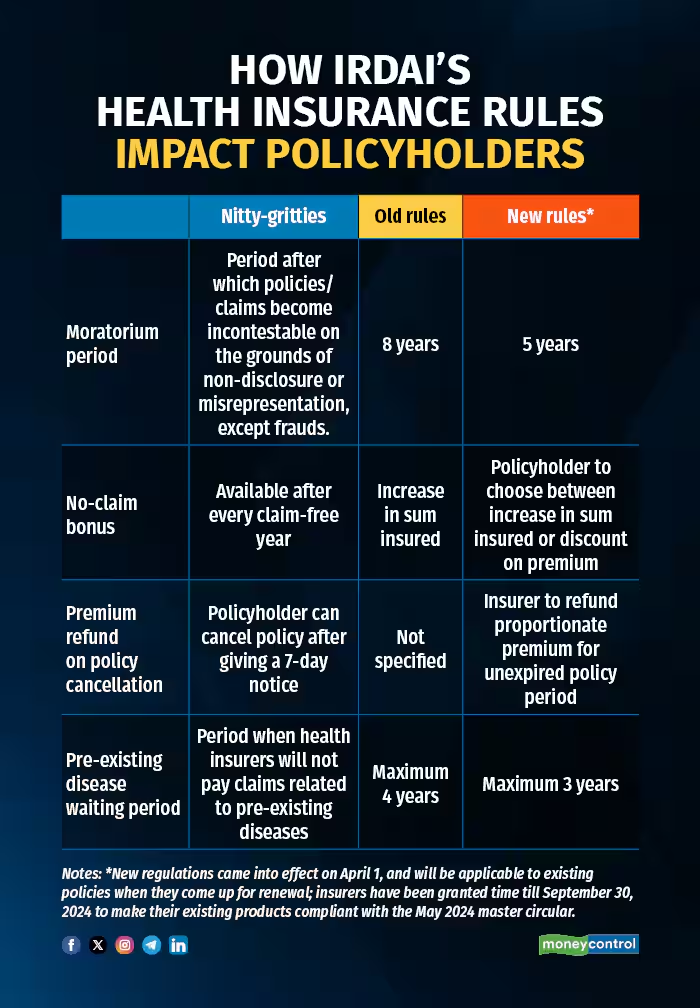

The Insurance Regulatory and Development Authority of India (IRDAI) has brought reforms that affect every buyer. The maximum waiting period for pre-existing diseases is now capped at 36 months. This means conditions like diabetes, hypertension, or thyroid disorders get covered sooner than before. The moratorium period for non-disclosure has been reduced to five years, offering more protection for long-term policyholders. Insurers have also been asked to design products for all age groups, ensuring even senior citizens have better options.

What It Means for Different Buyers

- Young professionals can take advantage of affordable premiums and shorter waiting periods.

- Families should carefully evaluate whether a floater or individual plan works better, especially for children and maternity needs.

- Senior citizens benefit most from the changes. Lifetime renewability and reduced entry barriers allow more flexibility in choosing cover even after 60 or 65.

Choose the Right Health Insurance: Checklist Before Buying a Policy

- Choose the right sum insured based on your city and hospital costs.

- Ensure your preferred hospitals are part of the cashless network.

- Check the waiting period for pre-existing diseases — look for 36 months or lower.

- Avoid policies with too many sub-limits on room rent or procedures.

- Look for useful add-ons like maternity, AYUSH treatments, or preventive check-ups.

- Confirm the policy offers lifetime renewability.

- Study the exclusions to avoid surprises during claims.

- Review the claim settlement process and customer support of the insurer.

Tips for Those With Pre-Existing Conditions

Always disclose your health conditions honestly. Non-disclosure can lead to rejected claims even after years of paying premiums. If you already have a policy, check portability options to shift to a better plan without losing continuity benefits. Consider a super top-up plan for higher coverage instead of only increasing your base policy.

Choose the Right Health Insurance: How KaroInsure Helps You

KaroInsure simplifies the process by offering instant digital comparisons of leading health plans. You can see premiums, hospital networks, and waiting periods at a glance. Policies can be purchased entirely online, without paperwork. Most importantly, KaroInsure provides dedicated claim assistance, ensuring quick approvals and hassle-free settlements. For families with elderly parents, the platform highlights senior-friendly plans and explains terms in simple language.

Conclusion

The reforms introduced by IRDAI in 2025 make health insurance more reliable and transparent than ever. Whether you are buying your first plan, upgrading an old one, or looking for senior citizen coverage, the new rules are in your favor. With the right plan chosen through KaroInsure, you can protect yourself and your loved ones against rising healthcare costs and ensure peace of mind during medical emergencies.

Leave a Reply