Fires can cause devastating damage to homes, offices, factories, and warehouses across India. To protect property and minimize financial losses, it is essential to understand the principles of fire insurance. Through its platform, KaroInsure helps Indian clients access IRDAI-approved fire insurance policies, ensuring coverage for residential, commercial, industrial, and agricultural assets while adhering to fundamental insurance principles.

Principles of Fire Insurance — Understanding the Basics

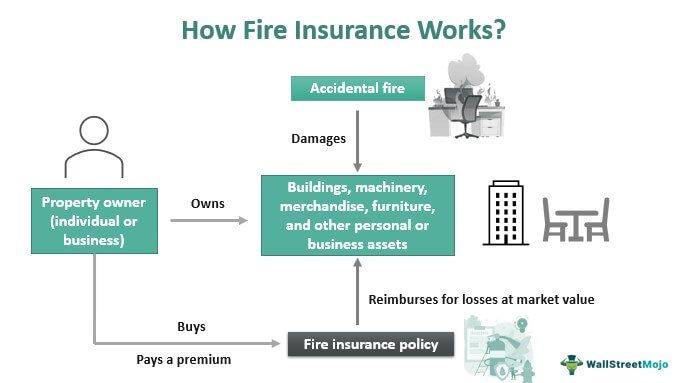

Fire insurance is a type of property insurance that provides financial protection against losses caused by fire, lightning, explosions, or related events. The principles of fire insurance are the foundation upon which all fire insurance policies are designed and executed. By following these principles, Indian clients can make informed decisions when purchasing fire insurance through KaroInsure’s trusted partner network.

Principles of Fire Insurance — Principle of Utmost Good Faith

One of the key principles of fire insurance is the principle of utmost good faith. Both the insurer and the insured must disclose all material facts truthfully. Non-disclosure or misrepresentation can lead to denial of claims.

- Indian clients purchasing fire insurance through KaroInsure are guided to provide accurate information about property, assets, and risk factors.

- Insurers rely on this principle to assess premiums and policy terms accurately.

Principles of Fire Insurance — Principle of Insurable Interest

The principle of insurable interest ensures that the policyholder has a legal or financial interest in the property being insured. Without insurable interest, a fire insurance policy is not valid.

- For Indian businesses, this includes ownership of buildings, machinery, stock, or equipment.

- Homeowners must have ownership or legal interest in their residence and contents.

- KaroInsure ensures that clients meet the insurable interest requirement before policy issuance.

Principles of Fire Insurance — Principle of Indemnity

The principle of indemnity is central to fire insurance. It states that the insured should not profit from a loss but should be restored to the same financial position as before the loss.

- Compensation is limited to the actual loss incurred.

- This principle prevents moral hazard and over-insurance.

- Through KaroInsure, Indian clients receive policies where indemnity is clearly defined for assets such as residential property, commercial buildings, or industrial equipment.

Principles of Fire Insurance — Principle of Subrogation

The principle of subrogation allows the insurer to take legal action against a third party responsible for the loss, after compensating the insured.

- For instance, if a fire in an Indian factory is caused by a neighboring property, the insurer may recover costs from the responsible party.

- KaroInsure explains this principle to clients, ensuring clarity about their rights and the insurer’s rights.

Principles of Fire Insurance — Principle of Contribution

If multiple policies cover the same asset, the principle of contribution ensures that the insured cannot claim full compensation from each insurer.

- This prevents over-compensation and ensures fairness among insurers.

- KaroInsure helps Indian clients coordinate multiple policies, such as residential fire insurance combined with commercial coverage, to avoid conflicts during claims.

Types of Assets Covered

Understanding the principles of fire insurance also involves knowing which assets can be insured. Common assets covered in India include:

- Residential Property: House structure, furniture, electrical fittings, and personal belongings

- Commercial Property: Offices, shops, stock-in-trade, and office equipment

- Industrial Property: Factories, machinery, raw materials, and finished goods

- Agricultural Assets: Farmhouses, storage sheds, crop stock, and farm equipment

KaroInsure guides clients in selecting policies that match the type and value of assets, ensuring adequate protection.

Importance for Indian Clients

Adhering to the principles of fire insurance is crucial for Indian clients because it:

- Protects assets and minimizes financial losses due to fire accidents

- Ensures compliance with IRDAI regulations and policy terms

- Prevents disputes and denial of claims due to non-disclosure or misrepresentation

- Promotes responsible insurance practices for businesses and homeowners

KaroInsure ensures that clients are aware of these principles and follow them when purchasing policies.

Claim Process in India

A smooth claim process depends on understanding the principles of fire insurance:

- Notify the insurer immediately after the fire incident

- Submit a detailed list of damaged assets along with fire brigade or police reports

- Provide documentation that confirms insurable interest and property value

- Allow the insurer’s surveyor to assess the damage

- Receive settlement based on actual loss under the principle of indemnity

KaroInsure supports Indian clients throughout the claims process, making it transparent and efficient.

Tips for Indian Clients

To maximize benefits, Indian clients should:

- Ensure complete and accurate disclosure of assets and risks

- Verify insurable interest before purchasing a policy

- Avoid over-insurance to comply with the principle of indemnity

- Understand exclusions, add-ons, and limits of coverage

- Maintain documentation for easy claim settlement

KaroInsure provides guidance and comparison tools, ensuring clients select policies that adhere to principles of fire insurance while meeting coverage needs.

Conclusion

In conclusion, the principles of fire insurance — utmost good faith, insurable interest, indemnity, subrogation, and contribution — form the foundation of effective fire insurance policies. Understanding these principles helps Indian homeowners, businesses, and industrial clients select IRDAI-approved policies that protect residential, commercial, industrial, and agricultural assets. Through KaroInsure, clients gain access to trusted insurers, clear guidance on coverage, and support throughout the claim process, making fire insurance simple, reliable, and fully compliant with regulatory standards in India.

Leave a Reply