Fires can cause significant damage to homes, offices, factories, and warehouses in India. To mitigate financial losses, it is essential for individuals and businesses to understand the types of fire insurance policy available. Through its platform, KaroInsure helps Indian clients explore and purchase fire insurance policies from trusted partner insurers, providing coverage for residential, commercial, industrial, and agricultural assets.

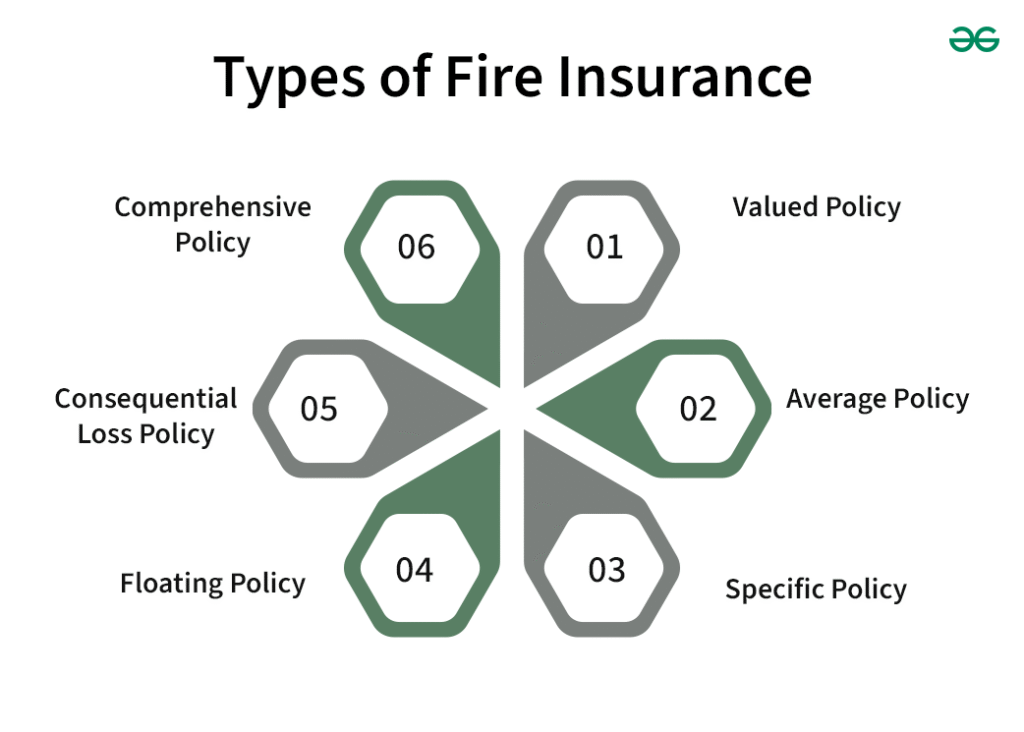

Understanding Fire Insurance

Fire insurance is a type of property insurance that provides financial protection against damage caused by fire, lightning, explosion, or implosion. Knowing the types of fire insurance policy helps Indian clients select the most suitable coverage based on the nature of their property and assets. KaroInsure ensures access to IRDAI-approved policies, providing clarity on coverage, exclusions, and benefits.

Standard Fire Insurance Policy

The most common option among the types of fire insurance policy is the standard fire insurance policy. It covers:

- Residential property, including walls, roof, and permanent fixtures

- Commercial property like shops, offices, and showrooms

- Damage caused by fire, lightning, and explosions

- Certain natural events, depending on policy terms

This policy is ideal for homeowners and small businesses seeking basic fire protection. KaroInsure guides clients in comparing premiums and selecting the best standard policy.

Industrial Fire Insurance Policy

For factories and large-scale operations, industrial assets require specialized coverage. The types of fire insurance policy in this category include:

- Coverage for factory buildings, warehouses, and production units

- Protection for machinery, boilers, and equipment

- Stock of raw materials, semi-finished goods, and finished products

- Additional protection for fire caused by electrical faults or industrial hazards

Through KaroInsure, Indian industrial clients can choose policies tailored to their operations and equipment value.

Commercial Fire Insurance Policy

Small and medium businesses in India often opt for commercial fire insurance. Among the types of fire insurance policy, commercial coverage typically includes:

- Office buildings, shops, and showrooms

- Furniture, fixtures, and office equipment

- Stock-in-trade and merchandise

- Optional add-ons like loss of rent or business interruption cover

KaroInsure helps business owners compare and select commercial policies, ensuring comprehensive asset protection.

Home or Residential Fire Insurance

Residential clients in India also benefit from understanding the types of fire insurance policy. Home fire insurance generally covers:

- House structure, including walls, floors, and roof

- Electrical installations, built-in furniture, and kitchen fittings

- Household goods, furniture, and appliances

- Optional add-ons for valuables, personal effects, or natural disaster coverage

KaroInsure simplifies the process for homeowners, providing access to policies that suit property type and asset value.

Agricultural Fire Insurance Policy

Agricultural properties face unique fire risks due to flammable materials and farm activities. The types of fire insurance policy for agricultural assets include:

- Farmhouses, storage sheds, and barns

- Crop storage and produce in warehouses

- Agricultural machinery and tools

- Coverage for fire caused by natural events like lightning

Through KaroInsure, farmers and agricultural businesses in India can secure specialized fire insurance tailored to their operational risks.

Add-On Coverage Options

Beyond the basic types, many fire insurance policies offer add-ons to enhance protection. These include:

- Loss of Rent: Covers rental income lost due to fire damage

- Debris Removal: Costs to clear damaged property after a fire

- Alternate Accommodation: Temporary housing for affected families

- Explosion and Implosion: Coverage for damage from sudden blasts

- Riot, Strike, and Malicious Damage: Extends protection to fires caused by social unrest

KaroInsure helps Indian clients customize policies with these add-ons for complete coverage.

Exclusions to Know

When considering the types of fire insurance policy, it is important to understand what is not covered:

- Losses due to war, invasion, or nuclear risks

- Fire caused by negligence or intentional acts

- Damage to cash, jewelry, or precious documents unless specified

- Wear and tear or gradual deterioration of property

KaroInsure guides clients in reviewing exclusions, ensuring policies meet expectations without surprises during claims.

Claim Process in India

Understanding the claim process is essential for any fire insurance policy. Indian clients using types of fire insurance policy can follow these steps:

- Notify the insurer immediately after the fire incident

- Submit documentation, including fire brigade and police reports

- Provide an inventory of damaged assets and supporting documents

- Allow insurer surveyor to assess losses

- Receive settlement based on verified damages

KaroInsure assists clients throughout the claims process, making it easier to recover losses quickly and efficiently.

Importance for Indian Clients

Awareness of the types of fire insurance policy is crucial for Indian homeowners, businesses, and industrial units. Proper coverage ensures:

- Protection of valuable assets from financial loss

- Peace of mind and security for families and employees

- Continuity of business operations after fire-related incidents

- Compliance with IRDAI regulations for insurance

KaroInsure connects clients with trusted insurers, providing policies that are transparent, reliable, and suitable for different asset types.

Conclusion

In conclusion, the types of fire insurance policy available in India include standard fire, industrial, commercial, residential, and agricultural policies. Each type offers coverage tailored to the specific needs of property and assets. By partnering with IRDAI-approved insurers, KaroInsure helps Indian clients select the right fire insurance policy, customize coverage with add-ons, and navigate claims efficiently. Understanding and investing in the right type of fire insurance policy ensures financial protection, operational stability, and peace of mind for individuals and businesses across India.

Leave a Reply