In today’s uncertain world, Term Life Insurance has become one of the most important financial safety nets for families. It’s simple, affordable, and designed to ensure that your loved ones remain financially secure even if life takes an unexpected turn. For anyone new to insurance, understanding how term life insurance works can help make smarter financial decisions and plan a stable future.

At KaroInsure, we simplify insurance for everyone — helping you understand, compare, and buy the right protection for your family’s needs.

What Is Term Life Insurance?

Term life insurance is a straightforward policy that provides financial coverage for a fixed period — called the “term.” If the policyholder passes away during this period, the insurer pays a lump sum (known as the sum assured) to the nominee.

Unlike other life insurance types that combine investment or savings, term insurance focuses purely on financial protection. That’s what makes it affordable and easy to understand, especially for first-time buyers.

How Does Term Life Insurance Work?

The working principle of term life insurance is simple:

- Choose your coverage amount (sum assured).

- Select the policy term (for example, 10, 20, or 30 years).

- Pay premiums regularly — monthly, quarterly, or yearly.

- If the policyholder passes away during the term, the nominee receives the benefit.

If the policyholder survives the policy term, there’s no maturity benefit unless the plan includes a return of premium feature.

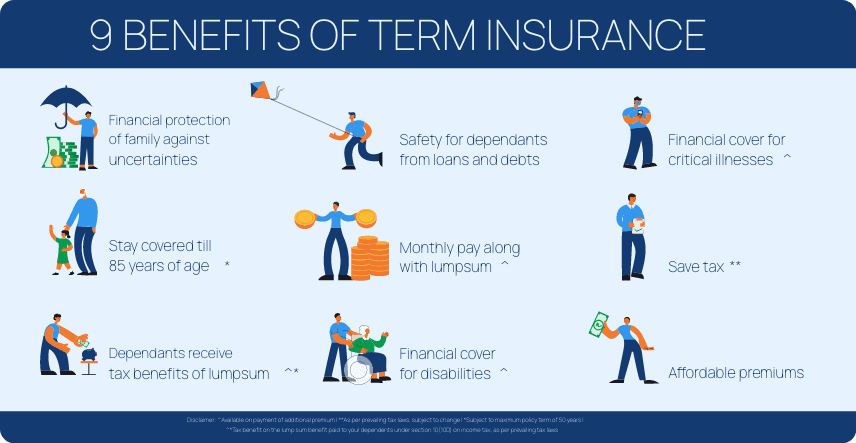

Benefits of Term Life Insurance

There are several reasons why term life insurance is essential for every earning individual:

- Affordable Protection: Get high coverage (even up to ₹1 crore) at a low premium.

- Family Security: Ensures that your dependents can maintain their lifestyle and meet financial goals.

- Debt Protection: Covers ongoing EMIs, loans, and other liabilities.

- Tax Savings: Premiums qualify for tax benefits under Section 80C, and payouts are tax-free under Section 10(10D).

- Flexible Options: You can customize coverage with riders like accidental death or critical illness cover.

At KaroInsure, we help customers compare these benefits across leading Indian insurers to find the best match for their needs.

Why Term Life Insurance Matters in India

India’s young working population faces multiple financial responsibilities — EMIs, education costs, and long-term family goals. A sudden loss of income can disrupt an entire household. That’s why term life insurance has become a necessity rather than a choice.

Buying term insurance early also helps you lock in lower premiums. Younger applicants are healthier and considered lower risk by insurers.

Types of Term Life Insurance Plans

Term plans come in different types to suit various needs and lifestyles:

- Level Term Plan: Fixed coverage throughout the policy term.

- Increasing Term Plan: The coverage amount increases annually to offset inflation.

- Decreasing Term Plan: Ideal if your financial liabilities (like a home loan) reduce over time.

- Return of Premium Plan: Refunds your total premiums if you survive the term.

- Joint Term Plan: Covers both partners in a single policy.

KaroInsure compares all these types across trusted insurers in India, ensuring you get transparent and value-driven options.

Common Mistakes to Avoid

New buyers often make simple yet costly mistakes when purchasing a policy. Avoid these to ensure maximum benefit:

- Choosing insufficient coverage for your family’s future expenses.

- Ignoring the insurer’s claim settlement ratio.

- Providing incomplete or incorrect health information.

- Delaying the decision — as premiums increase with age.

With KaroInsure, every policy recommendation is based on transparency, affordability, and your financial goals.

How to Choose the Right Term Plan

Choosing the right policy depends on your income, family size, debts, and future aspirations.

Here’s how KaroInsure helps simplify this process:

- Compare Plans: Get unbiased comparisons from multiple IRDAI-approved insurers.

- Understand Coverage: Learn what’s included, excluded, and available as add-ons.

- Get Expert Support: From choosing to claim, KaroInsure guides you every step of the way.

Real Example: Why Early Planning Pays Off

Consider two individuals — one who buys a term plan at age 25 and another at 35. The younger buyer pays almost half the premium for the same coverage because age and health significantly influence insurance cost. That’s why starting early is always the smarter move.

Conclusion

Understanding term life insurance is the first step toward securing your family’s financial future. It offers peace of mind, long-term stability, and protection at an affordable cost.

As a beginner, remember: the best policy isn’t always the cheapest — it’s the one that meets your needs completely. With KaroInsure, you can compare trusted insurers, understand every clause clearly, and make a confident choice for your loved ones.

Leave a Reply